Construction insurance explained

Published on September 16, 2025

Running a construction business comes with a lot of risks from personal injuries to property damage to construction delays and defects. To mitigate those risks and protect your business from a catastrophic financial hit, it’s important to have the right construction insurance policies and coverage in place.

Construction insurance is a broad term covering many types of insurance policies that provide a wide range of coverage to meet the needs of general contractors, subcontractors, project owners, and other parties involved in construction. In some instances, like with workers’ compensation and commercial auto insurance, it’s required by state law. Other policies like general liability insurance are often required as a prerequisite to obtain a contractors license or awarded a construction contract.

Some of the most common types of insurance and coverage related to running a construction business include the following policies.

Purchasing insurance for your construction business can be a daunting task. Multiple policies are needed to fully protect your business and those policies can vary on what is covered depending on your insurance provider. In addition to understanding what each policy covers, you also need to consider premium costs, policy limits, and deductibles.

For general contractors, another major challenge is requesting, keeping track of, and maintaining certificates of insurance for all their subcontractors and vendors. Not only is this needed to ensure those subcontractors and vendors carry the minimum levels laid out in the construction contract but those records need to be maintained in the event a claim is filed long after a project is completed.

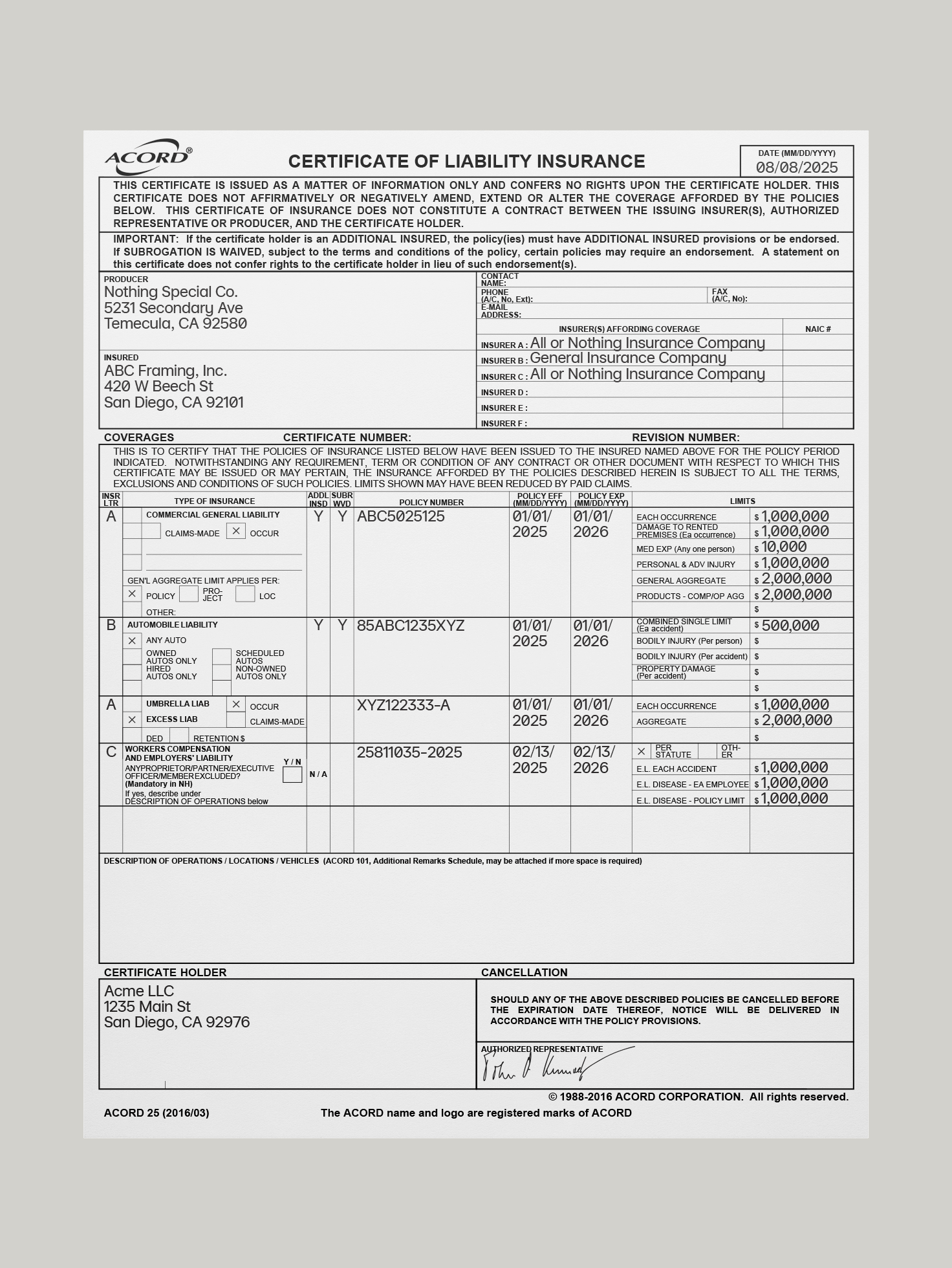

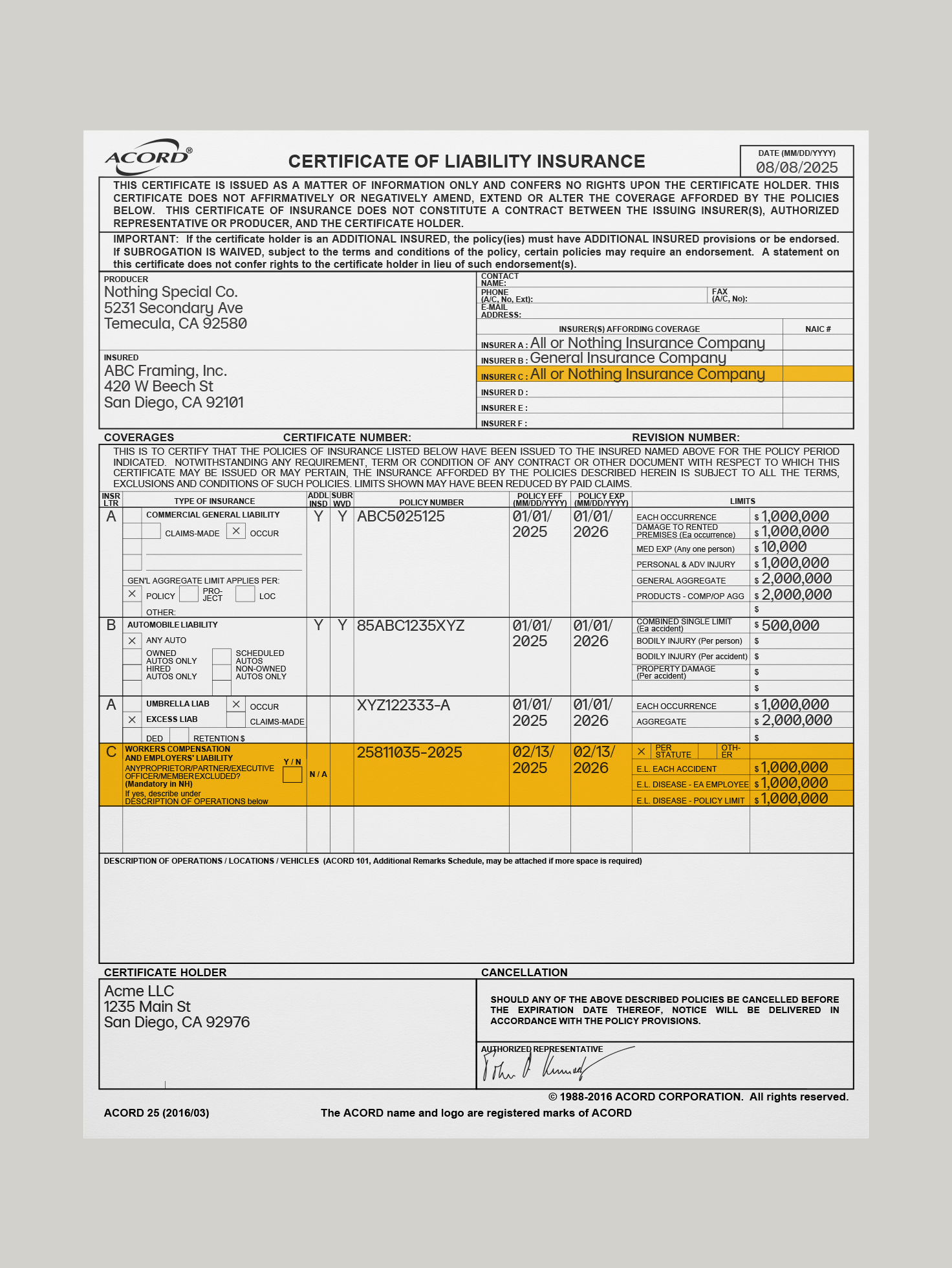

Certificate of insurance

A certificate of insurance (COI) a form providing proof of insurance. A standard COI typically includes the following information: name and address of insured, name of insurer providing coverage, insurance agent’s contact info, type of coverage, coverage amounts, description of coverage, policy number, effective and expiration dates, and the name and address of the COI holder.

While COIs contain most of the pertinent information regarding an insurance policy, they typically do not include information on any exclusions or endorsements of said policy. In fact, there is typically language stating that if the certificate holder is an additional insured, the policy must carry an endorsement to that effect and any statements on the COI do not confer rights to the holder if those endorsements aren’t on the actual insurance policy.

In many cases in construction the policyholder will be required to list whoever they are contracted by to list them as a certificate holder. For example, a general contractor may need to list a project owner as a certificate holder on their general liability insurance and a subcontractor may have to add a general contractor as a certificate holder on one or more of their insurance policies to show they have coverage.

Being a certificate holder means you're entitled to receive a COI which is just a form that shows policy dates, what and who is covered, and coverage limits. It's simply a way to prove to whoever you are working for that you have the necessary coverage to handle potential claims and that the certificate holder won’t be liable. It's simply a way to prove to whoever you are working for that you have the necessary coverage to handle potential claims and that the certificate holder won’t be liable.

If you’re a general contractor, it’s important to obtain and keep track of all of your subcontractors’ COIs. This should be part of your pre-qualification process as well as before they begin working on any project for you. This is a tedious and time-consuming process to request and keep up with, especially when you’re dealing with multiple subcontractors and projects. Not only is this needed to ensure those subcontractors and vendors carry the minimum levels laid out in the construction contract but those records need to be maintained in the event a claim is filed long after a project is completed.

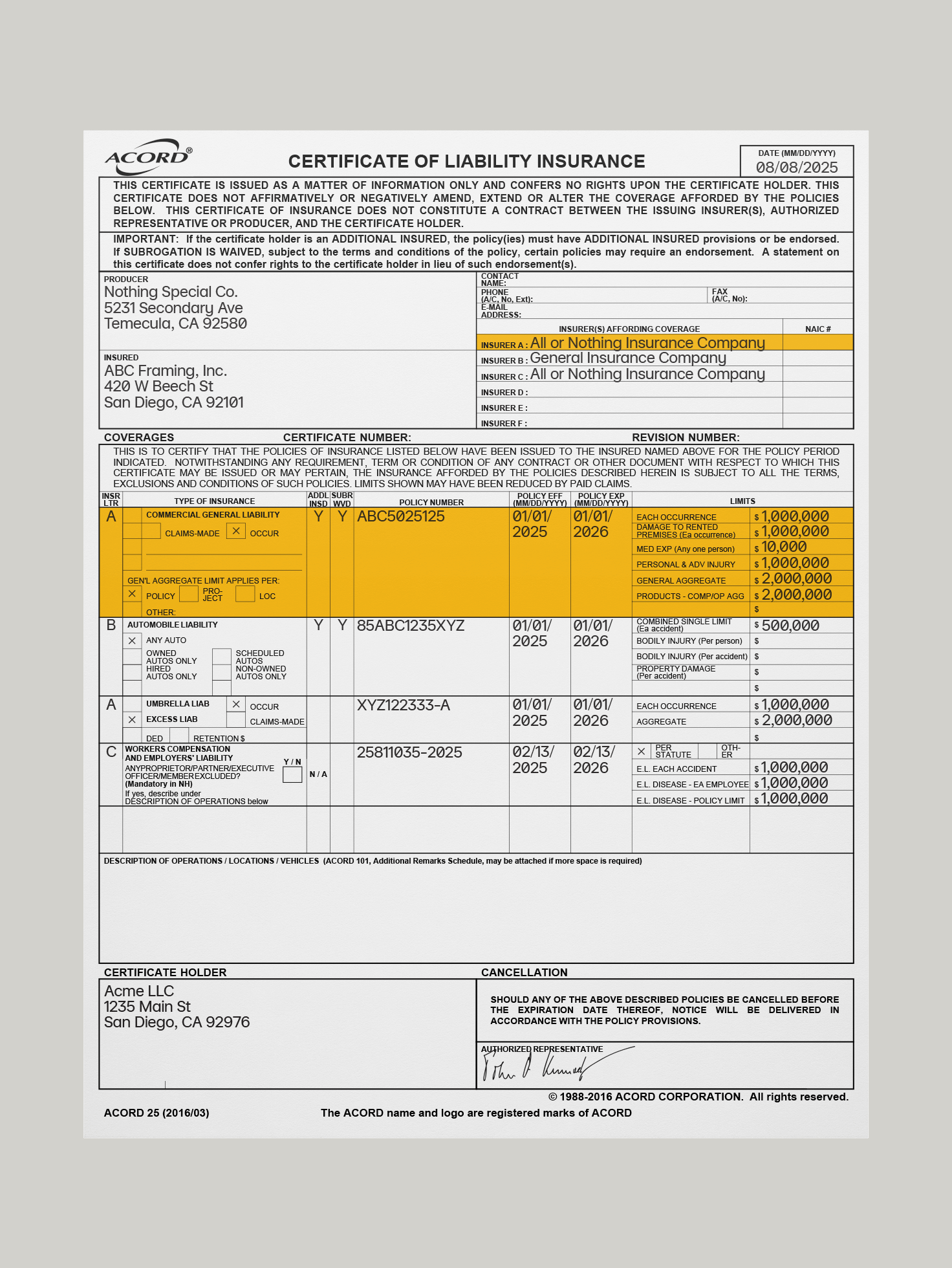

Commercial general liability

Sometimes referred to as general liability or contractor liability insurance, general liability insurance provides liability protection against claims of bodily injury and property damage that occur during the course of doing business. These claims commonly arise from jobsite injuries or faulty craftsmanship but can also cover things like defamation or advertising injuries claims.

General liability insurance policies are typically on a one-year term and have coverage limits that are both per incident and an aggregate for the term. The larger the construction firm, the higher the limits should be.

Because coverage periods are generally for one year, it’s important for contractors to ensure they have completed operations coverage as part of their policy which claims that may arise after work is completed for a set time period.

Other items to consider when selecting a commercial general liability coverage are the various waivers and endorsements available and should be determined by the size of the business, scope or work performed, and geographic areas where work is conducted.

In some states, commercial general liability insurance is required in order to obtain a contractor license. It’s also common that contractors have general liability coverage in order to be awarded a construction contract for both public and private projects.

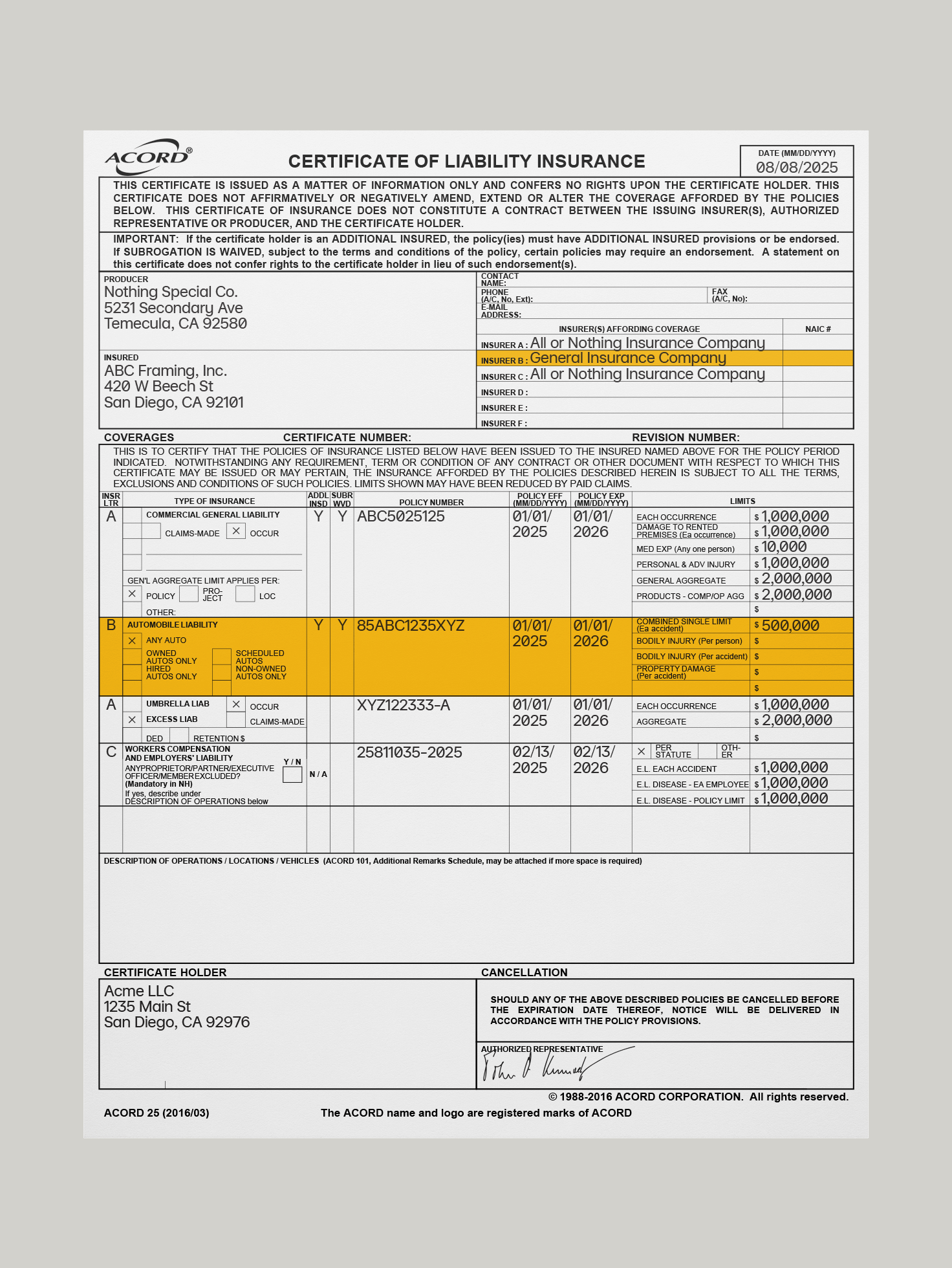

Automobile liability

Commercial auto insurance is required in every state and covers vehicles and some types of equipment, like dump trucks and cement mixers, that are company-owned. Policies provide coverage for business owners and their employees.

Like personal auto insurance, commercial automobile insurance policies offer various coverage options for liability; physical damage from collisions, theft, and vandalism; uninsured motorists; and medical expenses incurred from accident injuries.

It’s important to have adequate commercial auto because any out-of-pocket expenses from medical expenses and vehicle repairs and replacement could be financially devastating to a construction business.

Just like with personal auto insurance, commercial auto coverage and limits can vary and minimum coverage requirements may be dictated by state law. There are also various endorsements that can be added to the policy for additional insured drivers, employee coverage, towing and roadside repairs, and auto glass replacement.

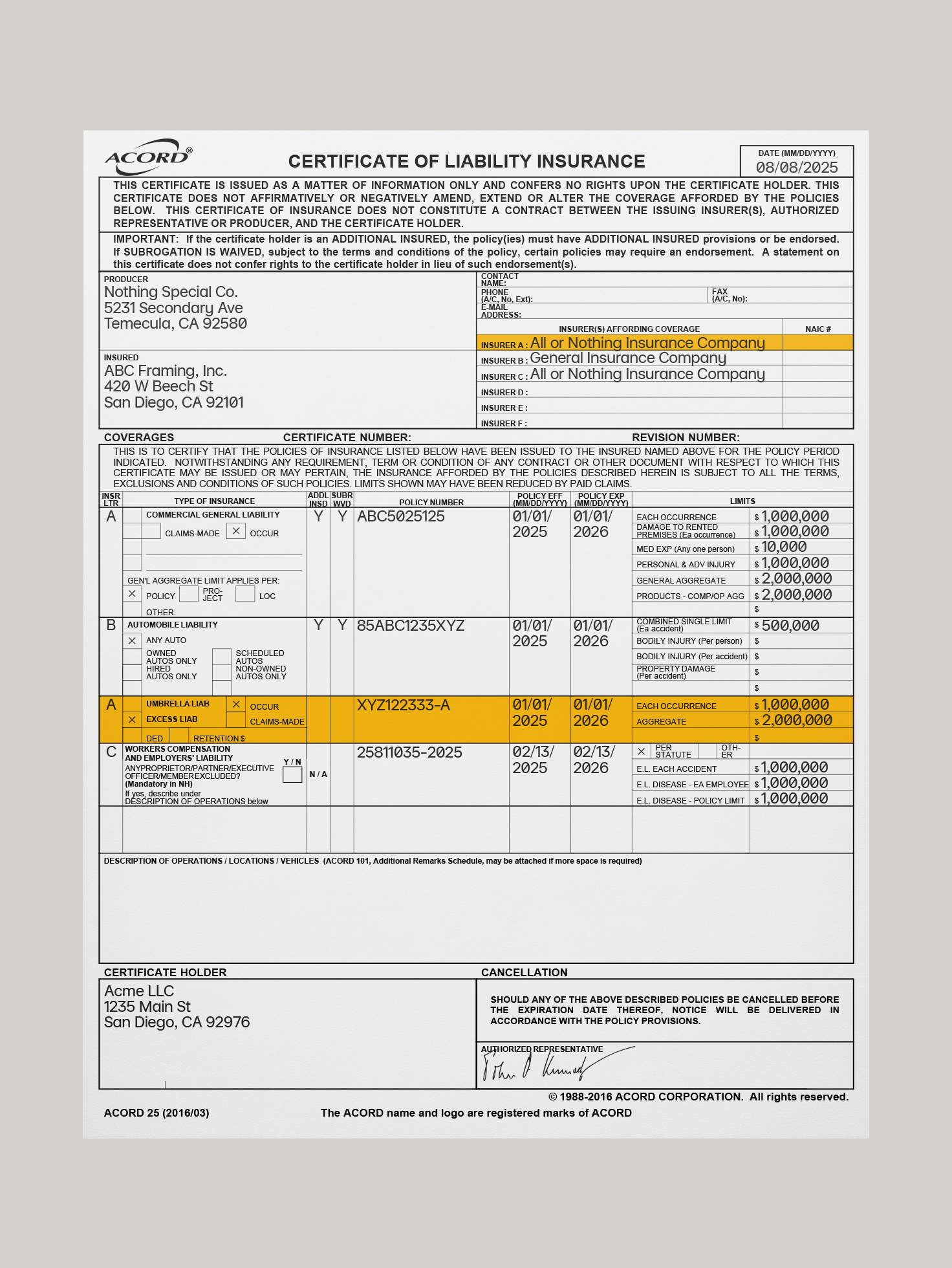

Umbrella or excess liability

Umbrella insurance provides extended coverage for your company’s liability policies like commercial general and auto. This can be extremely beneficial in the event of a large claim or multiple claims that are higher than what your existing liability policies cover. An umbrella insurance policy can cover more than one of your existing insurance policies.

Umbrella insurance is a great add-on option for contracts that require higher liability cover than your general liability policy provides or when working on high-risk projects to avoid having to pay out of pocket in the event of a claim that is higher than your policy limits. Umbrella policies offer broad comprehensive coverage to various risks not covered in the original policy.

Excess liability is similar to umbrella insurance in that it extends coverage but it differs in that it can only apply to your underlying liability policy and only extends the liability limits and nothing else.

Coverage limits for both umbrella and excess liability policies typically start at $1 million and go up from there depending on your needs. Endorsements are available for both types of insurance as well and can be tailored based on the risks faced.

Workers' compensation and employers liability

Workers’ compensation and employers liability policy protects business owners when an employee suffers a work-related injury or illness. Workers compensation typically covers medical expenses, lost wages, ongoing healthcare costs, and funeral expenses.

In every state except for Texas, workers’ compensation insurance is required if you meet or exceed a minimum threshold of employees, often as little as one employee. Failure to have workers’ compensation coverage for employees will result in civil penalties and fines. Some states can issue stop-work orders until you get proper coverage. Failure to carry workers’ compensation insurance can also result in criminal charges, both misdemeanors and felonies, and could result in jail time.

Depending on what state you are in also determines where you can purchase workers’ compensation policies from. Some states are monopolistic, meaning you can’t purchase private coverage and must purchase workers’ compensation through a state fund. Other states use the rates set by the National Council on Compensation Insurance (NCCI) and you buy coverage directly from the state or a contracted carrier. There are also some states who set their own rates and you buy coverage from a private insurance provider.

Coverage for workers’ compensation comes in two parts. Part A is for employee benefits to cover medical expenses, lost wages, and rehabilitation costs. This coverage is commonly unlimited but there may be state-specific regulations on the duration of coverage and specific benefits.

Part B is employer’s liability to protect employers from lawsuits that employees may file for workplace related injuries. The limits for employer’s liability are typically set per employee, policy, or accident.

Waivers or exemptions for workers’ compensation are rare and generally determined by individual state laws and regulations. These waivers are typically for sole-proprietorships, independent contractors, and self-employed workers. There are also exemptions for some industries like agriculture or domestic care.

Construction work is hazardous so it’s important that in addition to having workers’ compensation coverage, you provide ongoing safety training to your workers and ensure your jobsites are safe.

Professional liability

Also known as errors and omissions (E&O) insurance, professional liability insurance in construction provides coverage against claims resulting from negligence or mistakes in work performed.

Professional liability policies cover financial losses incurred by a third-party. For example, a roofer’s professional liability policy would cover the financial losses incurred by the general contractor if there were mistakes made while installing the roof on a structure. Unlike commercial liability, E&O insurance does not cover property damage or bodily injuries.

Professional liability policies typically can cover attorney fees and court costs, judgements and settlements, and repair costs. There are E&O policies for just about every trade involved in construction, including general contractors, engineers, architects, and specialty trade contractors.

Builders risk

Builders risk insurance, or course of construction insurance, provides protection when a building is under construction and can cover new construction, remodels, and renovations. This is a type of property insurance that can cover buildings, temporary structures, machinery, foundations, paving, and landscaping items installed by the contractor.

Builders risk insurance can be purchased by either the general contractor or owner and will provide coverage for all parties involved with the project. Damages caused by fire, theft, vandalism, structural collapses, and weather (typically excluding flood and earthquake damage) are covered in basic builders risk policies. Coverage also extends to building materials, tools, equipment, and supplies stored onsite, off-site, and when in transit.

Pollution liability

Pollution liability insurance protects against claims from environmental damage caused by hazardous waste and materials. Coverage varies by policies but can include bodily harm, property damage, clean–up and remediation costs, and legal fees.

Pollution liability insurance is common for contractors who do earthwork and site preparation as well as demolition and hazardous waste removal from construction sites.

Wrap insurance

Wrap insurance is a project-specific policy that combines general liability and workers’ compensation coverage for everyone on a job. Also known as a controlled insurance program or wrap-up insurance, they offer protection to the project owner, general contractor, subcontractors, and even sub-subcontractors.

There are two types of wrap insurance: contractor-controlled insurance program (CCIP) and owner-controlled insurance program (OCIP). A CCIP is purchased by the general contractor and as the policyholder they are responsible for paying the premiums and any deductibles. An OCIP is where the owner is the policyholder and pays the premiums and deductibles. CCIPs can cover multiple projects the general contractor is working on.

Wrap insurance policies can be written without the workers’ compensation coverage and can have additional coverage added like subcontractor default and umbrella insurance. Wrap insurance can be preferable, especially on larger projects, because it simplifies and streamlines the claims process since everything and everyone is covered under one policy.

Commercial property insurance

Commercial property insurance provides coverage from company-owned properties like offices and warehouses. In addition to covering the buildings themselves, commercial property insurance also protects the tools, equipment, and materials stored at those insured locations for damages from theft, fire, vandalism, and some weather-related causes like wind and lightning.

Contractors equipment insurance

Contractors equipment insurance provides coverage to tools and equipment owned or rented by a company. This is similar to commercial property insurance but has the added benefit of covering tools and equipment stored at jobsites and while in transit to and from your jobsites and commercial property. In addition to company-owned tools and equipment, most policies also cover those owned by your employees.

Subcontractor default insurance

Subcontractor default insurance (SDI) is a relatively new type of coverage that protects general contractors from losses, both direct and indirect, incurred from a subcontractor defaulting on a contract. SDI helps general contractors ensure that subcontractors provide quality work that is completed on time and within budget.

SDI insurance is geared toward larger projects, in terms of size, scope, and costs. Because these projects are more complex, they carry a greater risk for catastrophic subcontractor default. It can also be beneficial for general contractors who are overseeing a large number of projects each year.

SDI is similar to a performance bond in that they both are intended to provide financial protection in the event of subcontractor default. However, they differ in the parties involved, who is protected, and who gets paid in the event of a claim. Essentially, SDI provides better protection to the general contractor but also puts more responsibility on them to ensure that they properly vet and manage their subcontractors.

General contractors are required to pre-qualify their subs in order to obtain SDI and can determine when a subcontractor has defaulted on a project. Failing to complete work on schedule or performing shoddy work that needs to be redone causing additional costs and project delays are a couple of reasons that a general contractor might file a default claim on a subcontractor.

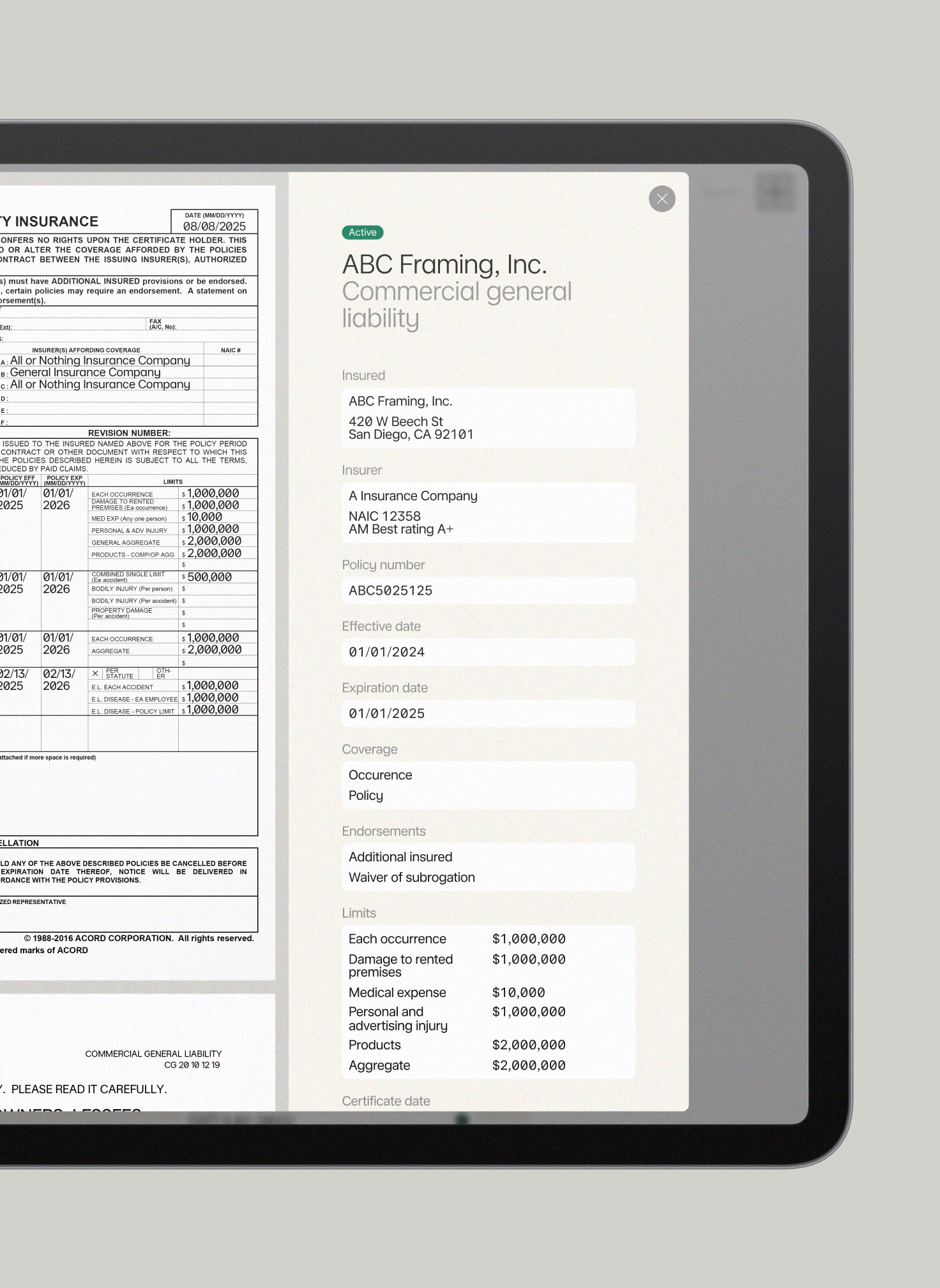

Automated insurance monitoring

With Area, the process of requesting and verifying COIs from your subcontractors is automated. This makes it easy to see which subcontractors are compliant and identify who needs to provide you with updated COIs.

Area automates the process of requesting COIs with specific policies and requirements such as coverage, limits, and endorsements by collecting them directly from each trade partner’s insurance provider.

Area makes it easy to see which subcontractors are compliant and identify who needs to provide you with updated COIs by sending you alerts when policies are nearing expiration.

Want to learn more? Book a demo today.