Trade partner pre-qualification guide for general contractors

and Mike Waldron

Published on January 21, 2025

Good working relationships are built on trust, but trust requires more than just good faith — it needs time, commitment, and some verification. Thorough contractor qualification is vital to ensure the selection of skilled, reliable, and financially stable trade partners. It ensures projects stay on schedule, risks are minimized, and costly delays are prevented.

Ensuring compliance involves collecting essential details and supporting documents, such as business information, licenses and certifications, litigation history, safety records, insurance coverage, surety bonds, financial health, and project backlogs. As projects scale, different qualification criteria and risk tolerance can be applied to each trade partner.

This guide covers common procurement practices, including the importance of qualifying subcontractors, what information to gather, and how to verify its accuracy. The goal is to equip you with the insights needed to confidently choose reliable trade partners for every project.

Business information

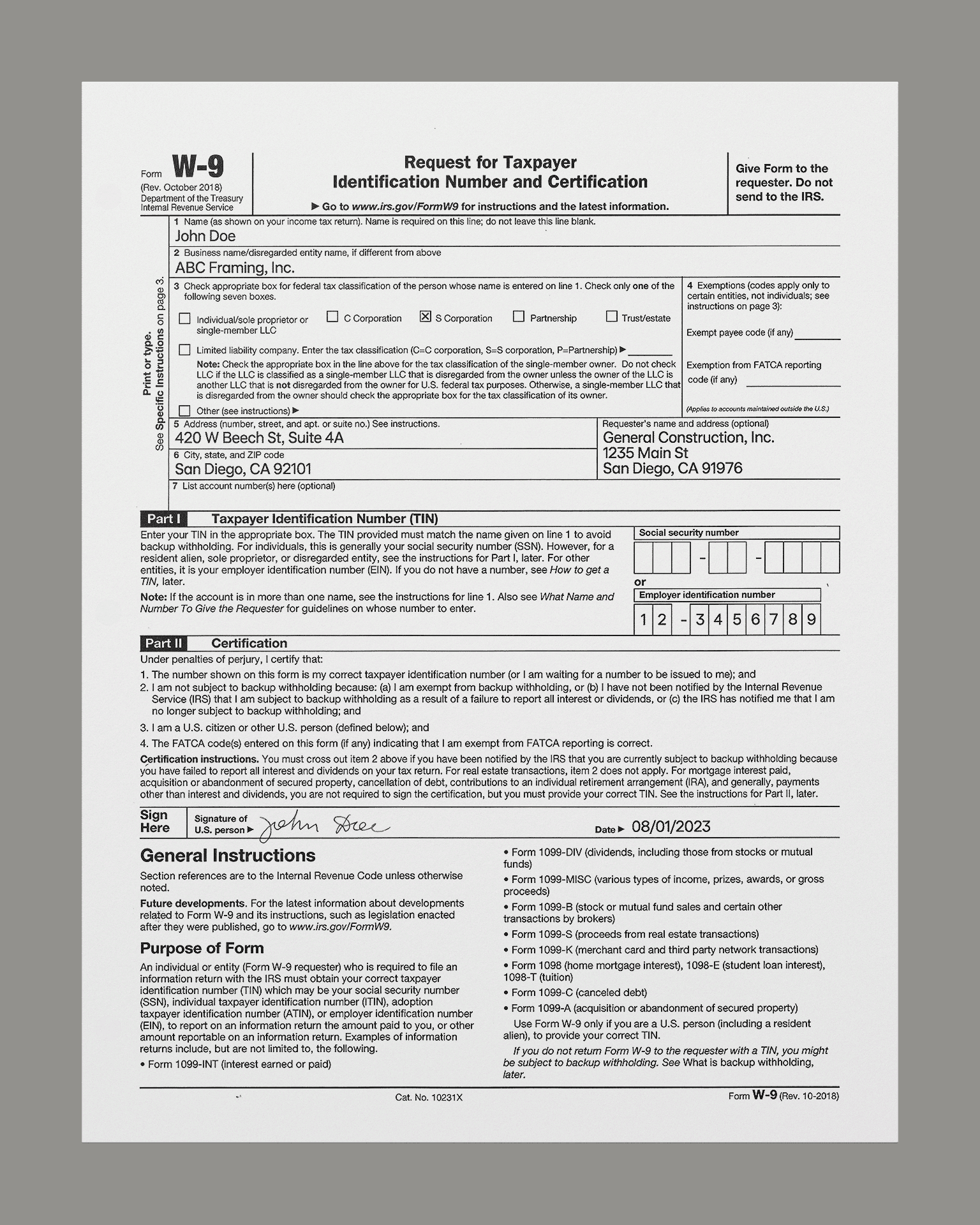

Begin with the basics, such as the business details, tax ID, trades, and location of a trade partner. It’s crucial to collect and verify everything to ensure there are no duplicate entries or fraudulent companies in the records.

Common documents to collect include the W-9 tax form, certificates of incorporation, an optional doing business as (DBA), and a state business registration certificate, among others.

- 1.1.

Business details include items like legal business name, optional “doing business as” or DBA name, and address, and contact information. All these will be used to further verify and score a trade partner.

- 1.2.

Entity type reflects a trade partner's business structure, influencing its operations, tax obligations, and assets at risk. Typically, larger contractors operate as corporations or LLCs, while smaller contractors tend to function as single-member LLCs or individuals.

- 1.3.

Tax Identification Number (TIN) is a unique identifier assigned by the Internal Revenue Service (IRS) for tax purposes. Its type varies depending on the entity's type. Most companies use an Employer Identification Number (EIN), while individuals or single-member LLCs may use the owner's Social Security Number (SSN) instead. It's essential to match TIN with IRS early to avoid wasting time on trade partners that can't pass this fundamental check.

- 1.4.

Trades performed — services provided by a contractor, preferably with relevant North American Industry Classification System (NAICS) and MasterFormat® codes from the Construction Specifications Institute (CSI).

- 1.5.

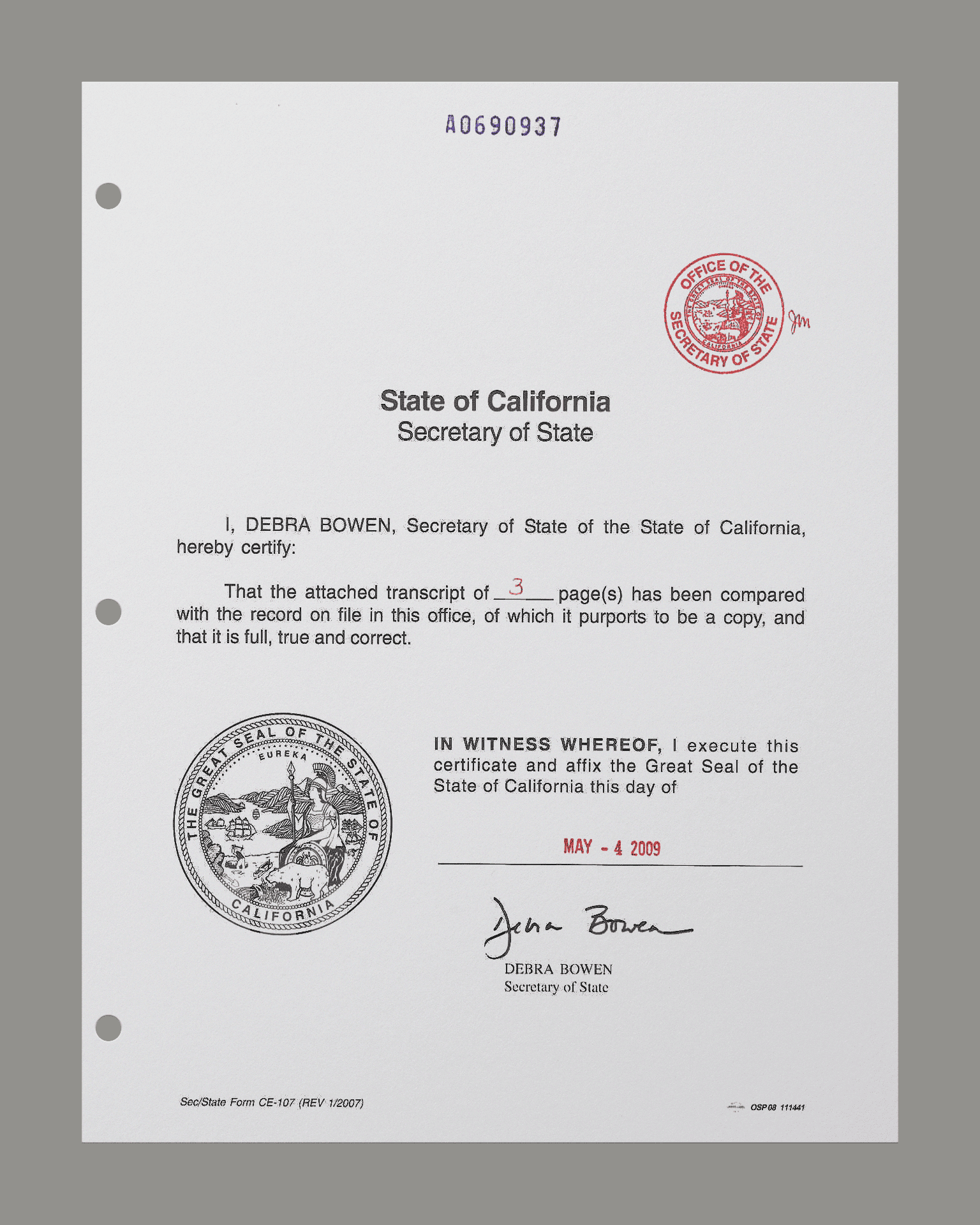

Business locations — States, counties, and areas where a contractor operates. Be sure to verify that the subcontractor is authorized to work in relevant jurisdictions and maintains good standing with local laws. This information is available through respective Secretary of State (SoS) portals, though accessing it may require an account or fees.

Licenses, unions, and certificates

Licensing, union affiliation, and certifications ensure subcontractors meet industry standards and legal requirements. Verifying these credentials confirms their qualifications, legal eligibility, and adherence to union or diversity agreements. Failure to check licenses and certificates could lead to legal penalties, project delays, or compliance issues.

Supporting documents to collect include proof of trade licenses, union affiliation, and diversity certificates from issuing authorities.

- 2.1.

Trade license, or contractor license in some states, is a key indicator of a legitimate construction business, demonstrating professional expertise and legal authorization to operate within its jurisdiction. Most states require specialty contractors to be licensed, and working without one can be illegal. State regulatory boards ensure contractors have the necessary knowledge to handle essential tasks, such as proper header thickness, electrical panel wiring, and the safe operation of gas-fired water heaters. A valid license not only protects the project from legal risks but also showcases the contractor’s commitment to industry standards, enhancing their credibility and trustworthiness. Consequently, states actively pursue unlicensed contractors, shutting down their operations and imposing fines before allowing them to seek proper licensing.

- 2.2.

Union affiliation means that a business hires workers from a construction union — a group of organized construction workers, tradespeople, or laborers. Union contractors benefit from the union's ability to negotiate fair wages, benefits, and safe working conditions for its members. As a result, union subcontractors typically have more highly trained and safety-conscious workers, as well as lower workforce turnover compared to non-union contractors.

- 2.3.

Diversity certificates are a formal recognition that a business is at least 51% owned, operated, and controlled by individuals from a recognized minority group, otherwise known as a Minority or Women Business Enterprise (M/WBE). General contractors should hire M/WBE-certified subcontractors because it can help them ensure compliance with federal, state, and local contracting rules.

Safety records

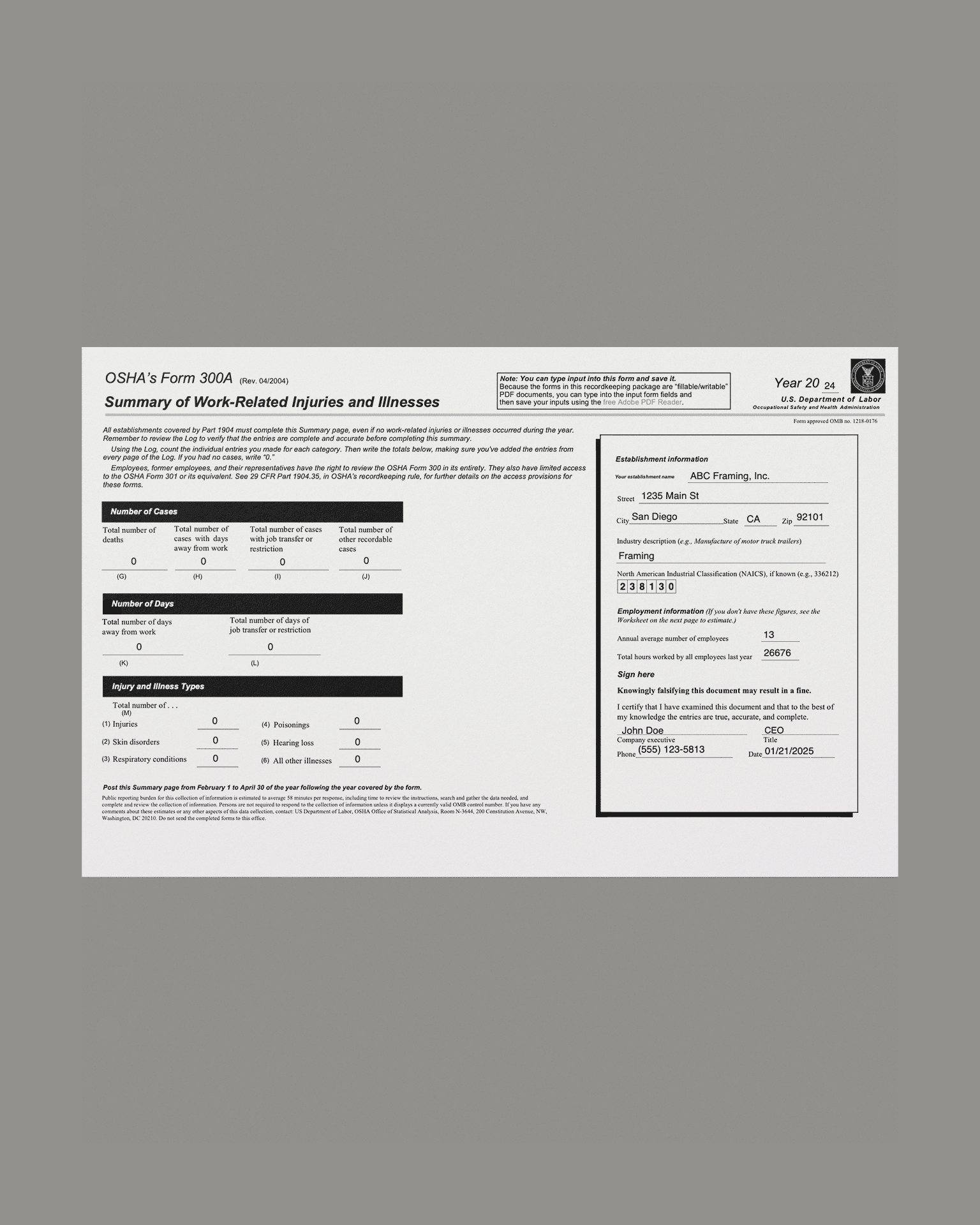

A strong safety record reduces workplace risks, ensures compliance with Occupational Safety and Health Administration (OSHA) regulations, and protects against liabilities while verifying safety practices demonstrate a subcontractor’s commitment to quality and workforce well-being. Poor safety records or a lack of safety policies signal potential risks, costly delays, or legal issues.

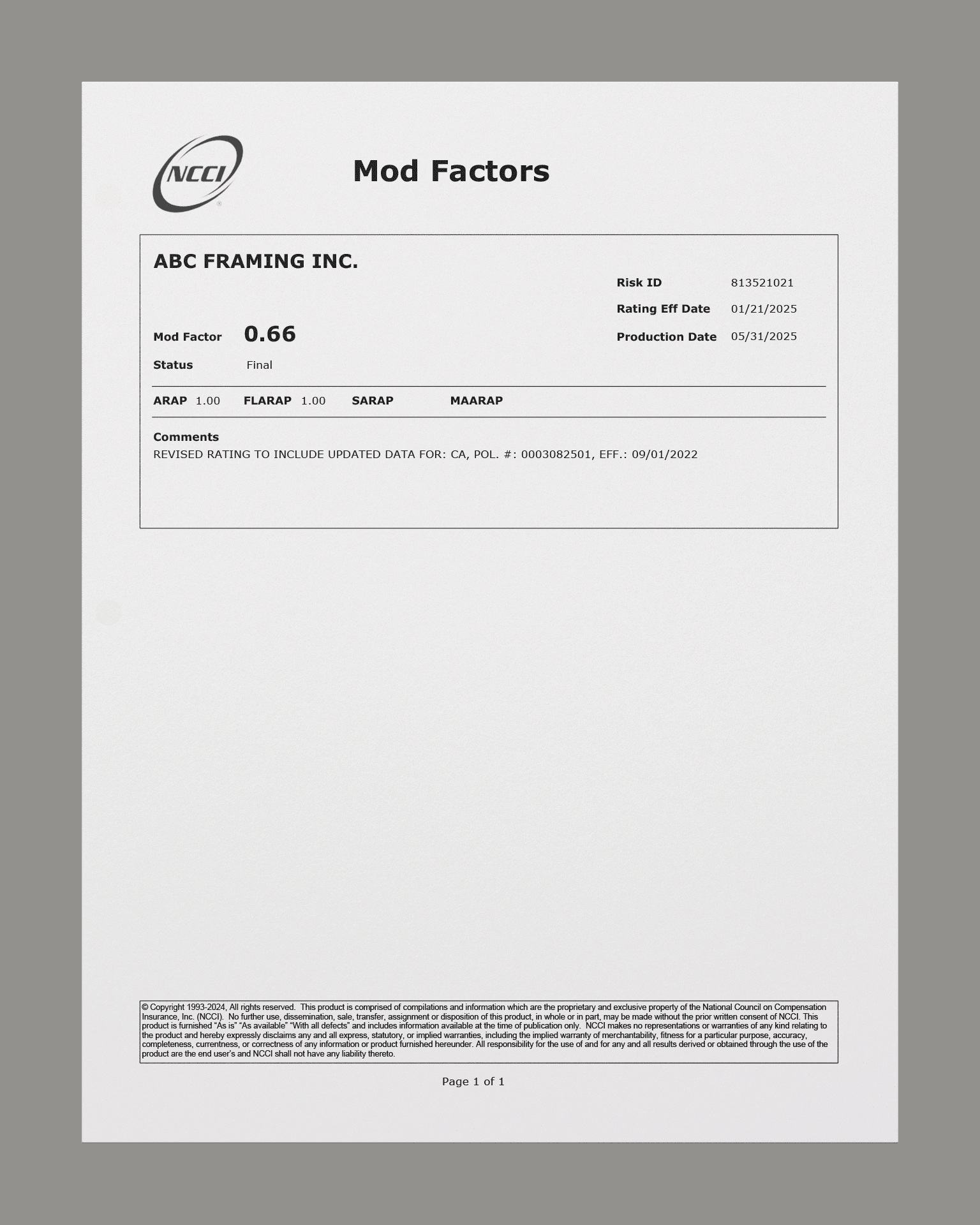

Important indicators include OSHA safety records, Experience Modification Rate (EMR), and any available safety policies.

- 3.1.

Incident rates — are contended by OSHA and include both Total Recordable Incidents Rate (TRIR) and Days Away, Restricted, or Transferred (DART). TRIR describes the rate of employees per 100 full-time employees that have been involved in an injury or illness on record. DART is the rate of recordable incidents per 100 full-time employees who had to take time off, face restricted duties, or be reassigned due to work-related injuries or illnesses.

- 3.2.

Experience modification rate (EMR) is a value calculated by insurance carriers and is an indication of Worker’s Compensation claims history. EMR reflects the ratio of actual losses to expected losses, but it can be an imperfect indicator, often penalizing smaller companies more heavily than larger ones.

- 3.3.

Safety program is a written set of procedures and standards designed to protect workers on a job site; typically these include policies, training, inspections, a reporting system, and follow-up with contractors to ensure compliance and maintain a safe work environment. Even though there’s no strict rule that regulates safety programs, OSHA requires contractors to train their teams, preparing them for the specific hazards they may encounter on each project site.

Litigation history

A subcontractor’s litigation history can severely impact a project’s timeline, budget, and success, as ongoing or past legal disputes — such as labor law violations or contract defaults — may signal financial instability or poor performance. These legal issues can also hinder a subcontractor’s ability to complete the work, particularly if their assets are tied up in litigation.

Be sure to ask potential trade partner for their litigation history for the prior three to five years.

- 4.1.

Bankruptcies — trade partner bankruptcy increases the chance of an employer paying twice for work done.

- 4.2.

Legal disputes are claims or disputes that are brought to court for adjudication. A judgment is the final decision issued by the court at the conclusion of a lawsuit.

- 4.3.

Liens are claims against a property by creditors for them to collect what they’re owed.

- 4.4.

Labor law violations are any failure to adhere to legal standards regarding employee compensation, working hours, and workplace safety. Other issues include unsafe working conditions, retaliation against employees who report violations, and non-compliance with prevailing wage requirements on public works projects.

Insurance and surety coverage

The right insurance and surety coverage protect a project from risks like accidents, property damage, or contractor failure to complete the job. Insurance covers both parties for unforeseen incidents, while surety bonds offer financial security in case the subcontractor defaults on their obligations.

Verifying a subcontractor’s insurance and bonding capacity is crucial to protecting both parties from significant financial risks. Failing to do so can expose both parties to severe losses or even lead to bankruptcy.

Always make sure to collect proper COIs and surety bonds before letting a trade partner on a job site.

- 5.1.

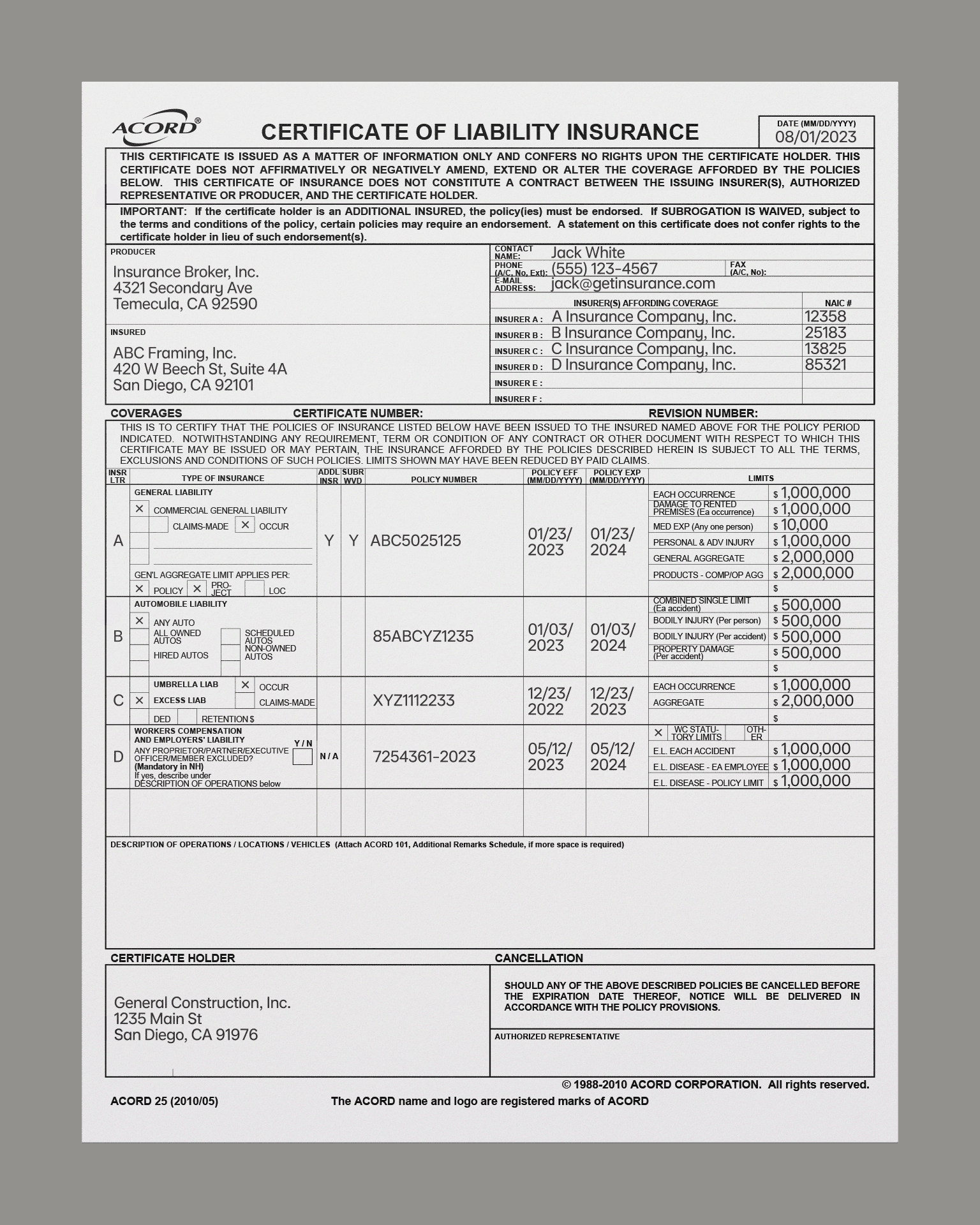

Certificate of Insurance (COI) serves as proof of insurance coverage and outlines the types and limits of coverage, effective dates, and the insurance carrier's contact information. A COI or ACORD 25 form, works alongside endorsements to ensure that the subcontractor and interested parties — lender, owner, and general contractor — are all protected by the subcontractor’s insurance coverage on the project.

- 5.2.

Surety bonds serve as a safeguard for owners against issues like non-payment, subpar performance, company defaults, and warranty problems. Known as contract bonds, they ensure that the bondholder will uphold the conditions of the contract.

Financial health

Assessing a trade partner’s financial health is crucial for determining whether they can meet contractual obligations and complete the project without disruptions.

This process involves reviewing key financial documents and ratios — such as balance sheets, profit and loss (P&L) statements, cash flow statements, and proof of credit lines — to gauge the level of financial risk associated with the subcontractor. Red flags, like ongoing losses, poor liquidity, or sudden changes in accounting methods, should raise concerns about potential financial distress that could jeopardize project timelines and budgets.

- 6.1.

Balance sheet summarizes a company’s assets and liabilities at any given point, while the income statement highlights the vendor’s income and expenses over a specific period.

- 6.2.

Profit and loss statement or P&L is a financial report that summarizes a company's revenues, expenses, margins, and net profit or loss over a specific period of time. It allows for better project budgeting, cost control, and overall profitability assessment by understanding exactly how much the subcontractor is spending on labor, materials, and overhead to complete their previous jobs.

- 6.3.

Cash flow statements offer a detailed view of a vendor's income and expenses over a set period. Analyzing cash flow can reveal any gaps in income or excessive spending. It’s important to ask your vendor targeted questions about this to gain a clearer picture.

- 6.4.

Proof of credit letter from a bank confirming a contractor’s total borrowing capacity and current credit line usage.

Red flags may include ongoing losses, poor liquidity ratios, or abrupt shifts in accounting methods. It's important to be cautious of any irregularities that could indicate financial distress or potential risk to project completion.

Project backlog

The backlog reveals the amount of work the subcontractor is currently committed to and whether they can dedicate enough resources to your project. An overloaded backlog could lead to costly delays or incomplete work if the subcontractor cannot balance their commitments effectively.

- 7.1.

Work-in-progress (WIP) report usually provides information on the contract amount, estimated and actual costs, percent completed, billed revenue, earned revenue, and any discrepancies in billings.

- 7.2.

Project backlog is the work a contractor has secured but hasn't started yet. Contractors usually add a project to their backlog once they’re sure they’ve been selected for the job, even if a formal contract hasn’t been signed. Projects in the bidding process are typically excluded.

- 7.3.

Reference contacts from the completed projects for quality assurance.

Application submission

When evaluating trade partners, it’s crucial to request detailed documents, including financial records, insurance, certifications, and safety reports. However, this process is often painfully manual, requiring multiple phone calls, emails, and hours spent managing spreadsheets. It can take up to 60 days to collect everything, with no guarantee of accuracy or efficiency.

Once the information is gathered, keeping it up to date is another challenge. Continuous updates and ensuring the security of sensitive data adds complexity, creating delays and risks. The entire process is time-consuming, redundant, and frustrating, leading to unnecessary complications for everyone involved.

- 8.1.

Build a list of questions and supporting docs according to contractor qualification criteria and risk tolerance.

- 8.2.

Build a publicly accessible and secure pre-qualification form for contractors to fill out and securely upload supporting docs. Normally it should live on a general contractor’s website.

- 8.3.

Then extract important data into a spreadsheet, such as key values, statuses, and expiration dates.

- 8.4.

Run checks for business information, trade licenses, certificates, and litigation history with issuing authorities or verification sources.

- 8.5.

Maintain data, monitor expiration dates and update docs when time comes.

A better way would be to rely on Area to do it for you.

Area handles everything compliance, from pre-qualification to onboarding. It helps contractors mitigate risk, save time, and cut costs, all from a single place.

Want to learn more? Ready when you are.