New York public work contractor certification (PW55) guide

Published on January 21, 2025

Contractors and subcontractors who perform public and certain private construction work in New York need to be aware of a new law requiring registration with the New York State Department of Labor (NYSDOL). Contractors must obtain a Public Work Contractor Certificate (PW55) before bidding on or starting work on any public construction project on or after December 30, 2024.

After December 30, 2024, contractors who bid on a project or start work on a covered construction project without a NYSDOL contractor registration will be subject to a civil penalty of up to $1,000. Any bids received without it will be disqualified and any work started by either a contractor or their subcontractor could be issued a stop work order.

Follow this step-by-step guide to get your construction business registered to avoid any fines and delays.

Check your eligibility

Registration is required for contractors and subcontractors doing public construction work and on private construction projects covered under Article 8 of the Labor Law and includes certain risk-related projects, broadband, energy transition, excavation, and renewable energy projects, and projects receiving public subsidy funding.

A contractor is considered any entity that enters into a contract to perform alterations, construction, custom fabrication, demolition, excavation, installation, reconstruction, rehabilitation, renovation, or repair, which is subject to Article 8 of the Labor Law.

There are a couple of instances where a contractor or subcontractor will not be able to register with the NYSDOL.

If a contractor or subcontractor is currently debarred their application will be declined. The same goes for contractors and subcontractors who are deemed ineligible under Section 141-b of the Workers’ Compensation Law or Section 220-b(3) of the Labor Law. Applications can be made once the debarment or ineligibility period has ended.

Contractors and subcontractors that are currently subject to a court or final administrative order for violating state or federal prevailing wage laws are also ineligible to apply until they have been fully satisfied and proof has been provided to the Commissioner of Labor.

Prepare required information

The following information and supporting documents are required when applying for a Certificate of Registration.

- 2.1.

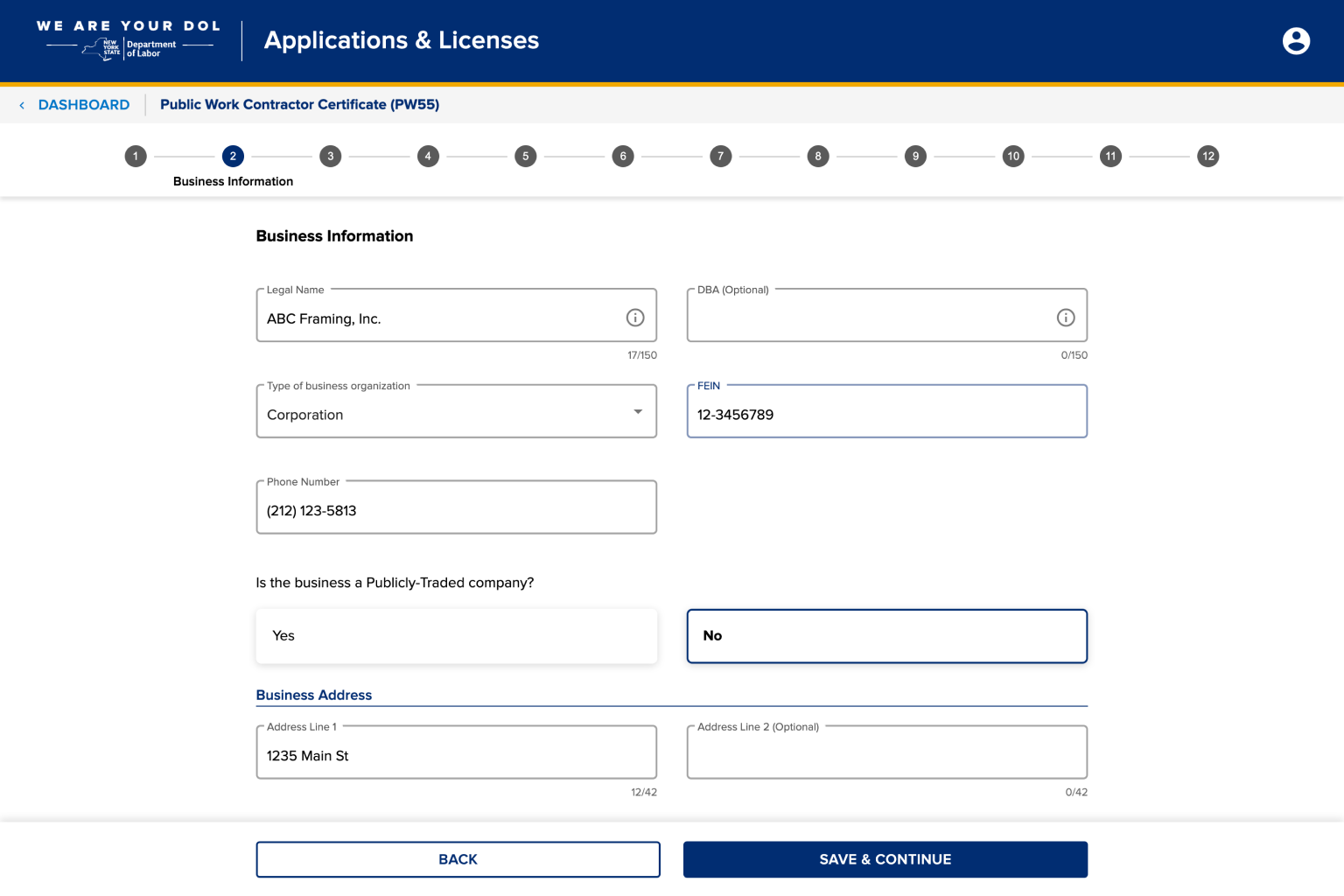

Business name and principal address

- 2.2.

Contact phone number

- 2.3.

Status as a person, partnership, association, joint stock company, trust, corporation, or other form of business entity

- 2.4.

The name, address, and percentage interest of each person with an ownership interest

- 2.5.

The names and addresses of the corporation's officers, if applying as a publicly traded corporation

- 2.6.

Tax identification number (TIN)

- 2.7.

Unemployment insurance registration number

- 2.8.

NYS Workers’ Compensation Board employer number

- 2.9.

Outstanding wage assessments

- 2.10.

Federal or state debarment history over the last eight years

- 2.11.

Final determinations of violations of any labor laws or employment tax laws, if any

- 2.12.

Final determinations of violations of any workplace safety laws or standards, including federal Occupational Safety and Health Act (OSHA) standards

- 2.13.

Participation in a New York state apprenticeship program, if applicable

- 2.14.

Status as a New York State certified Minority or Women-Owned Business Enterprise (M/WBE), if applicable

- 2.15.

Proof of workers’ compensation insurance coverage or certificate of exemption

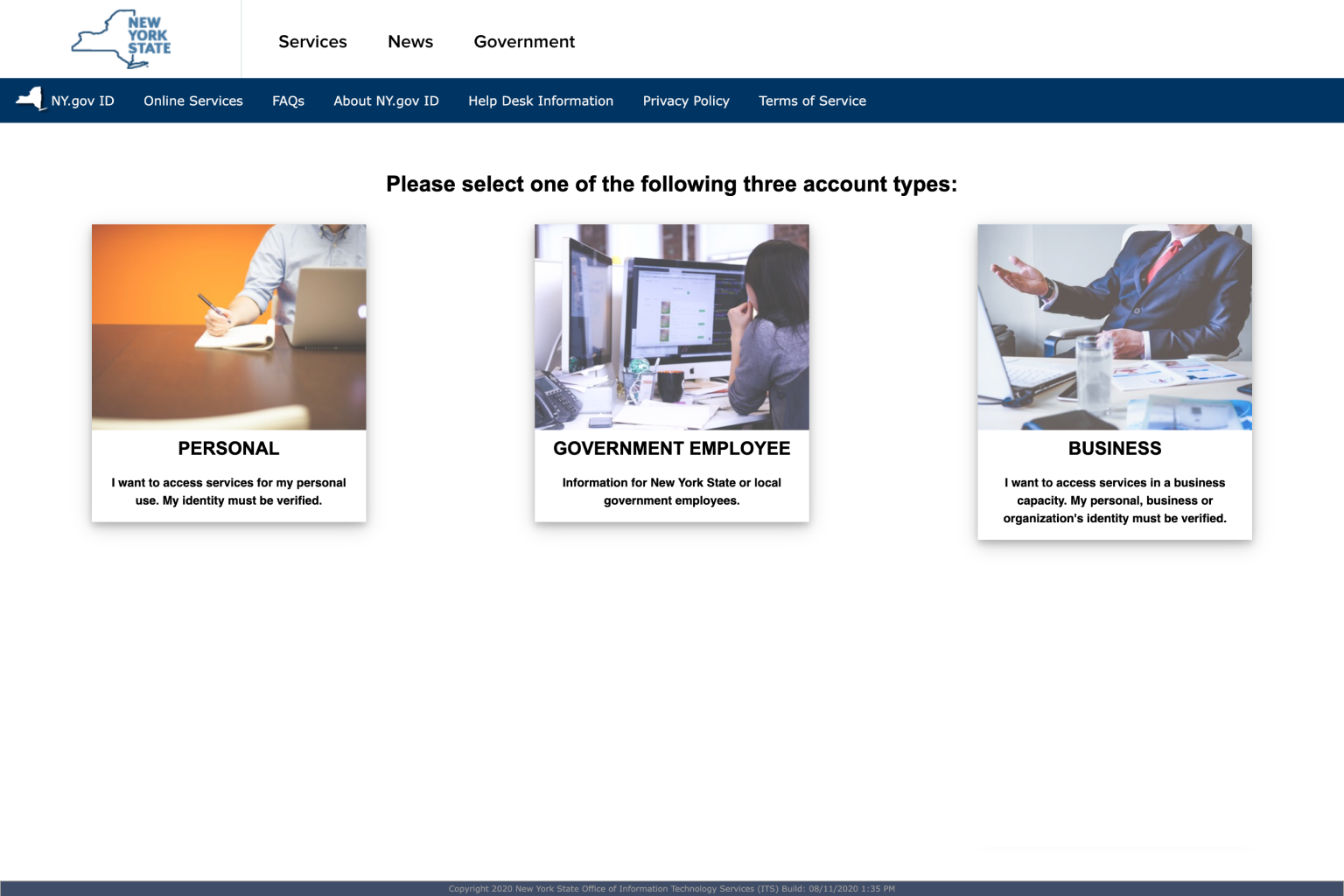

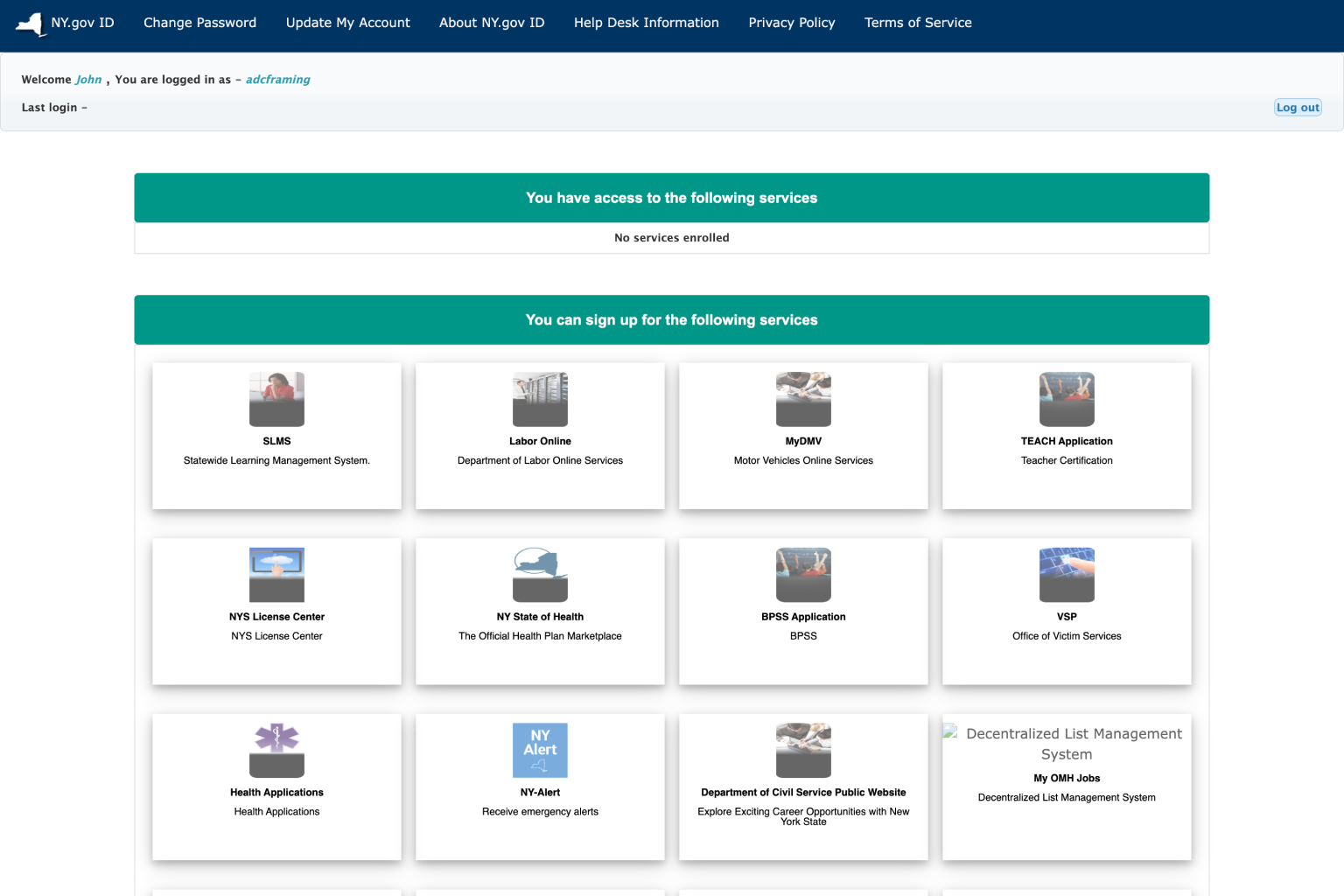

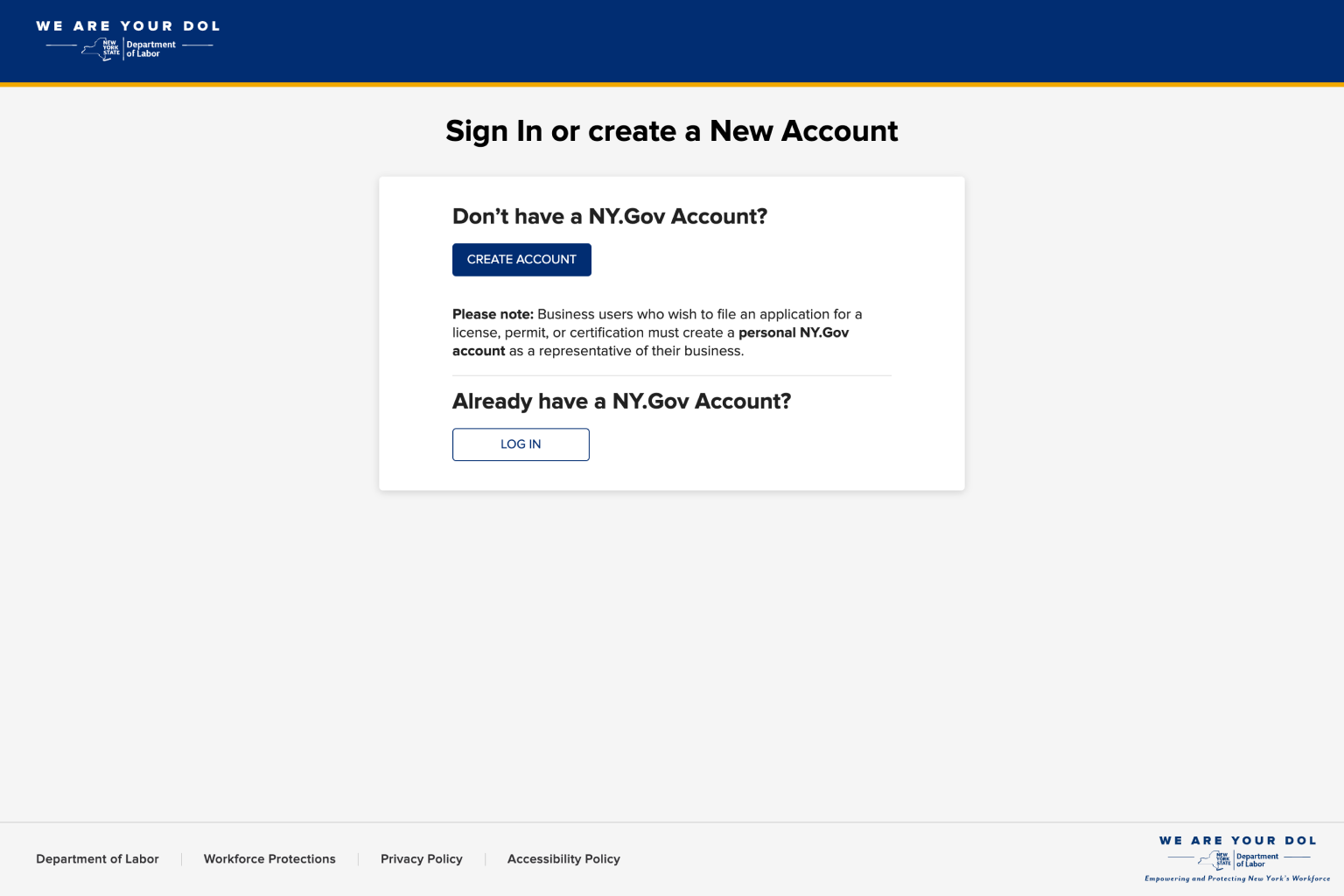

Create a NY.gov ID

A NY.gov ID is a username and password that allows private users to securely access online services offered by New York State agencies. Business users filing an application for a license, permit, or certification must create a personal NY.Gov account as a business representative.

If you have a NY.gov ID, proceed to step 4.

- 3.1.

Go to NY.gov ID registration, select personal account, and click “Sign up for a personal NY.gov ID”

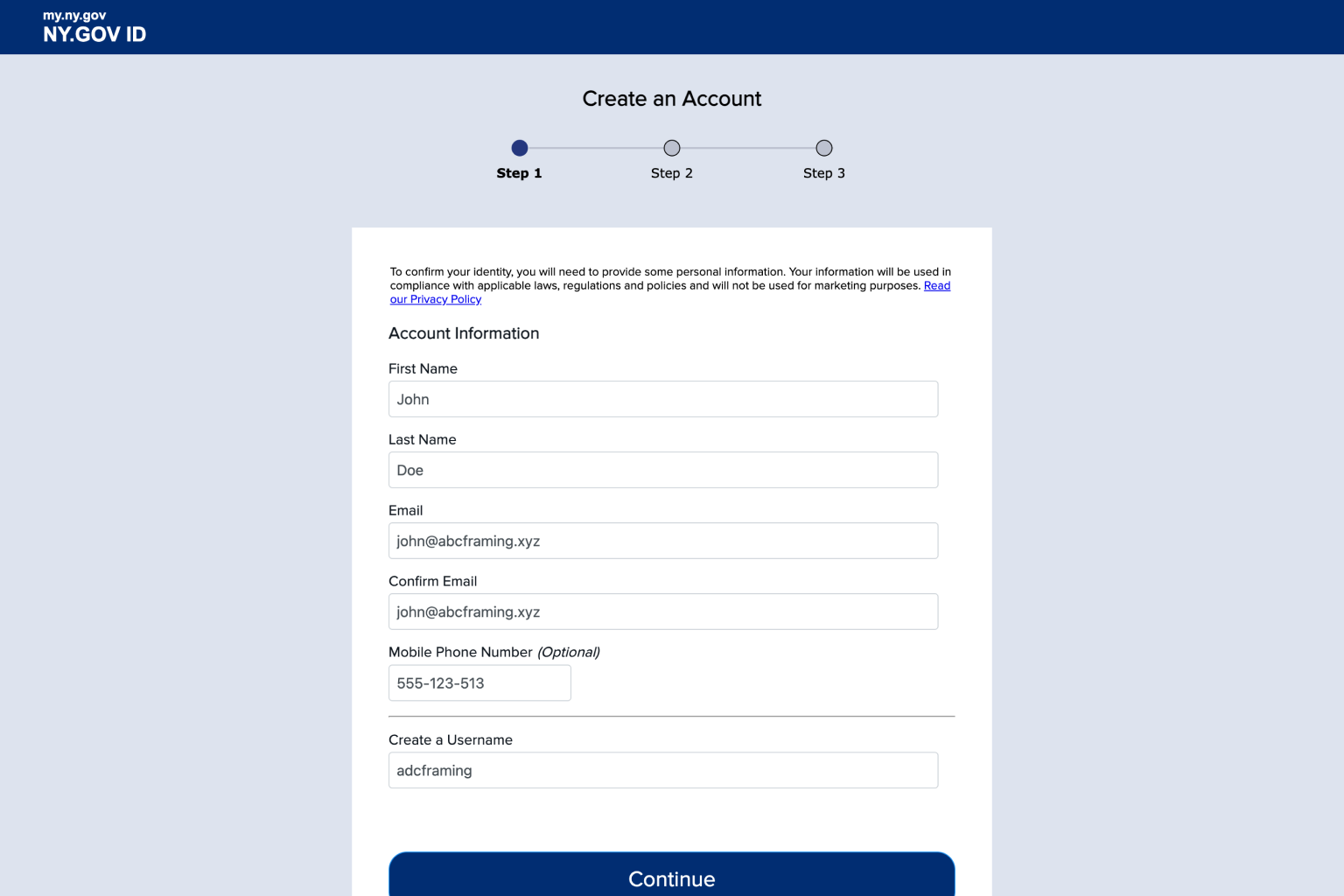

- 3.2.

Enter account information and click “Continue”

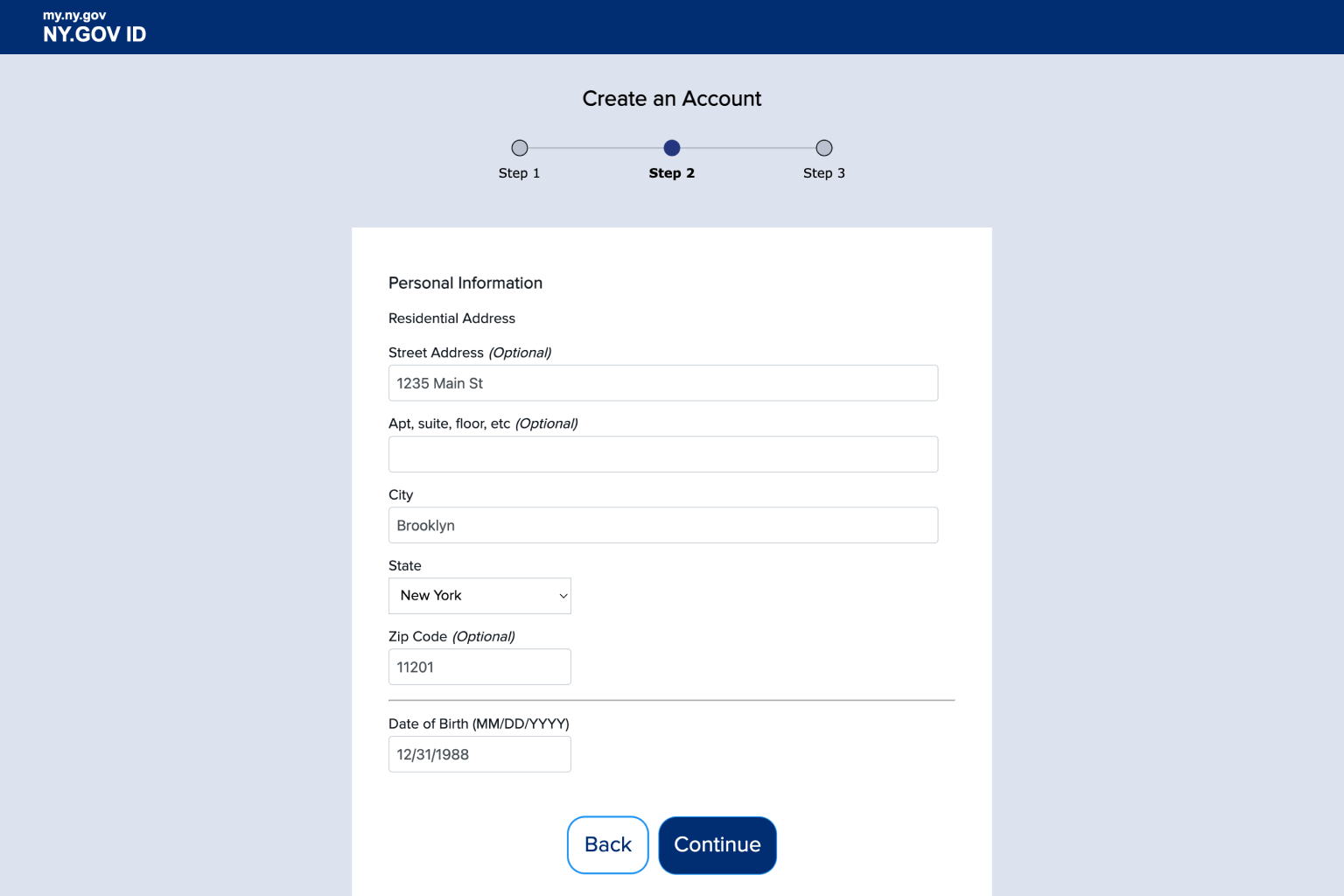

- 3.3.

Enter personal information and click “Continue”

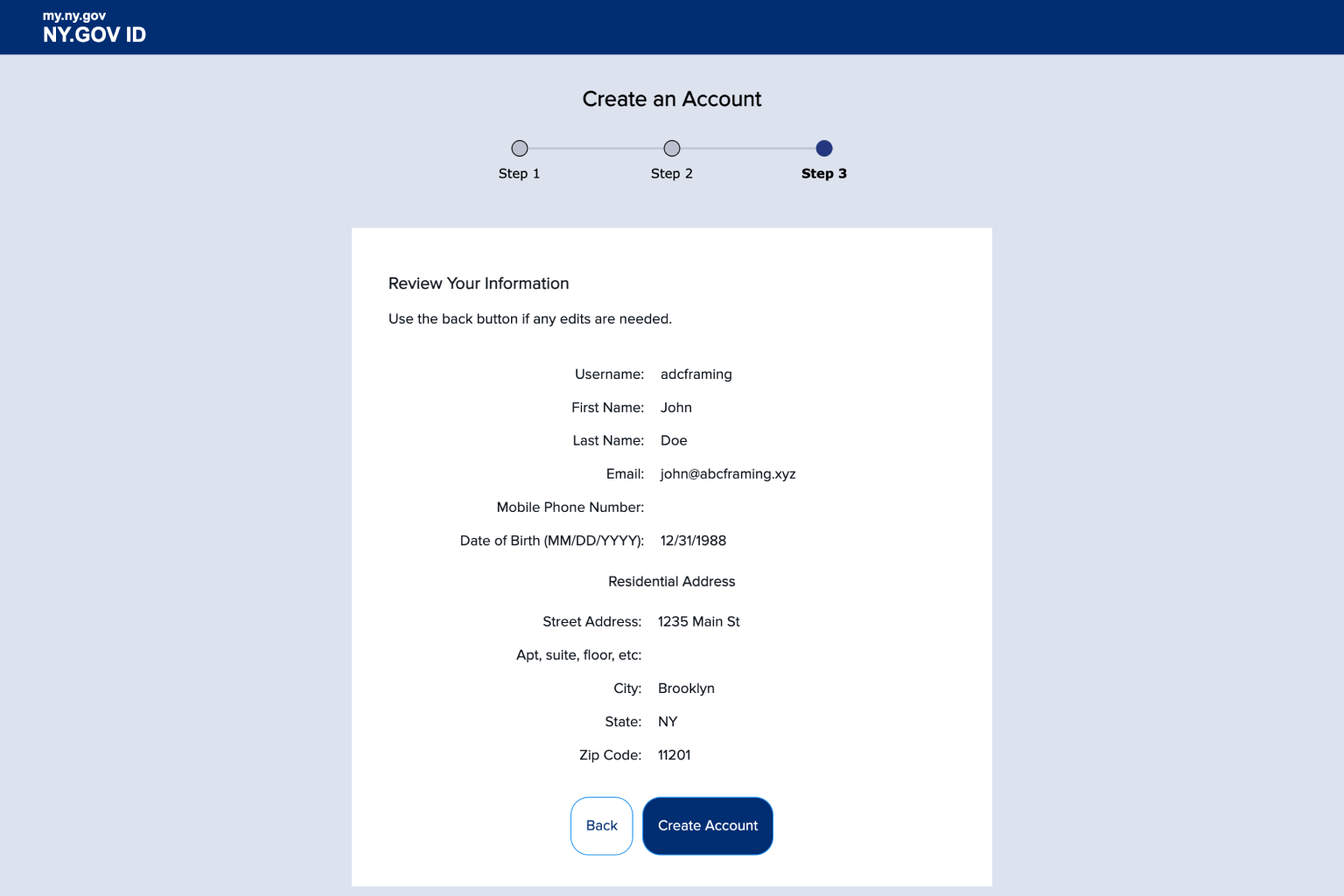

- 3.4.

Review your information and click “Create account”

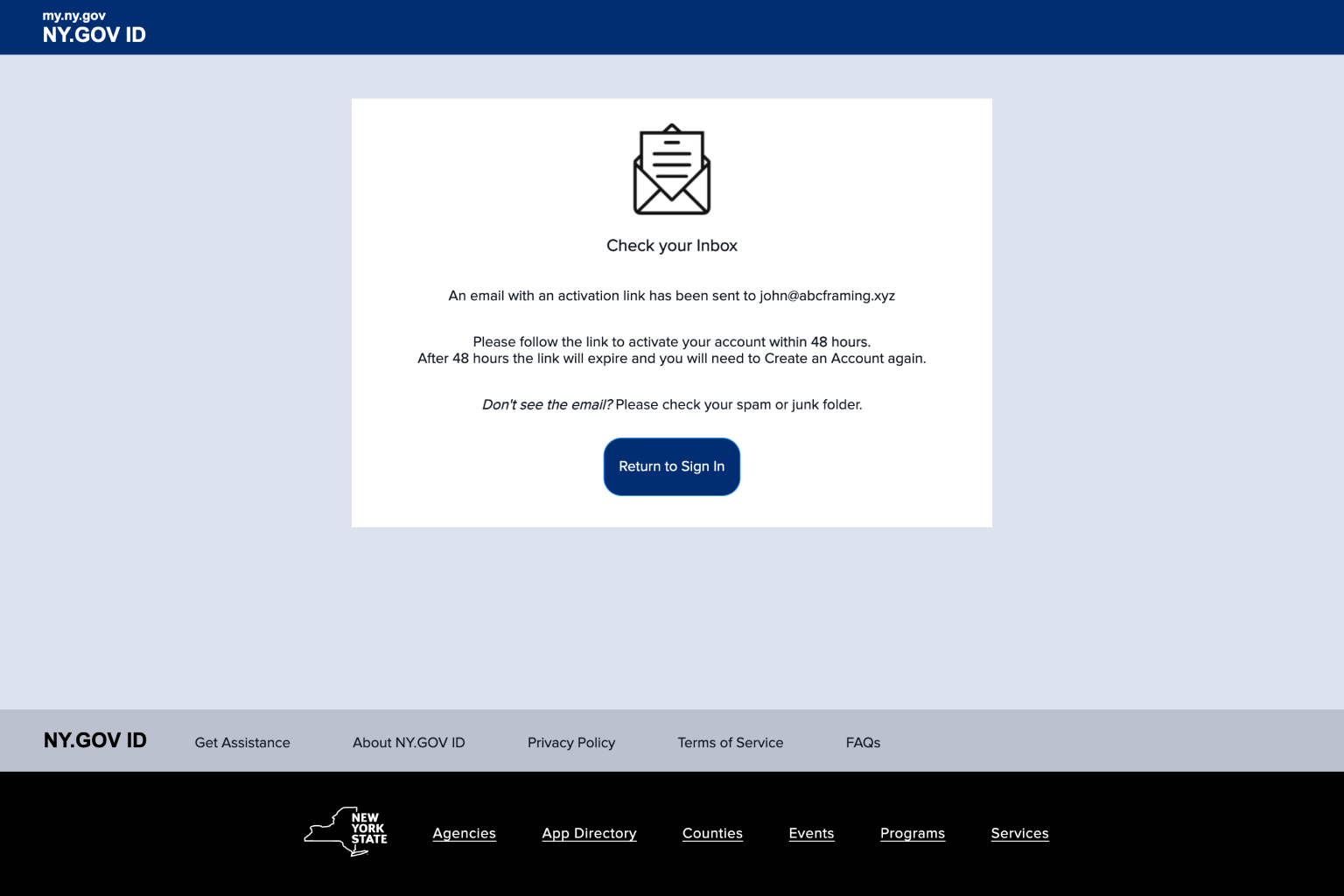

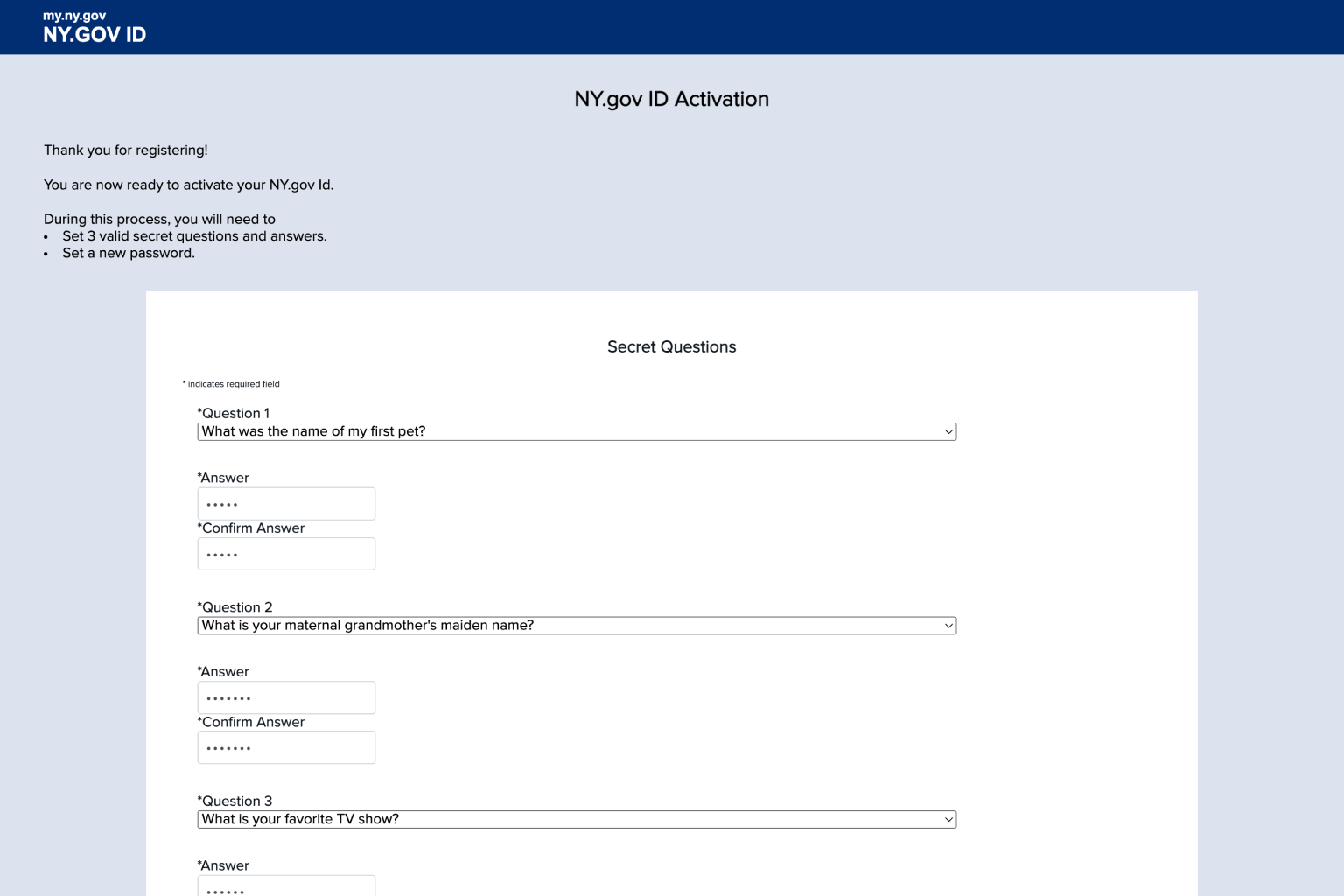

- 3.5.

Activate your account by clicking link sent to your email

- 3.6.

Set your password, select your secret questions and answers, and click “Continue” to complete.

Your NY.gov account is now active.

Submit your application

Once you’ve gathered all the required documentation and have an NY.gov account, complete and submit your registration application through NYSDOL’s Contractor Registry portal on their Management System for Protecting Worker Rights (MPWR).

The registration fee is $200 for both contractors and subcontractors. Minority and Woman-owned Business Enterprises (M/WBEs) pay a reduced fee of $100.

- 4.1.

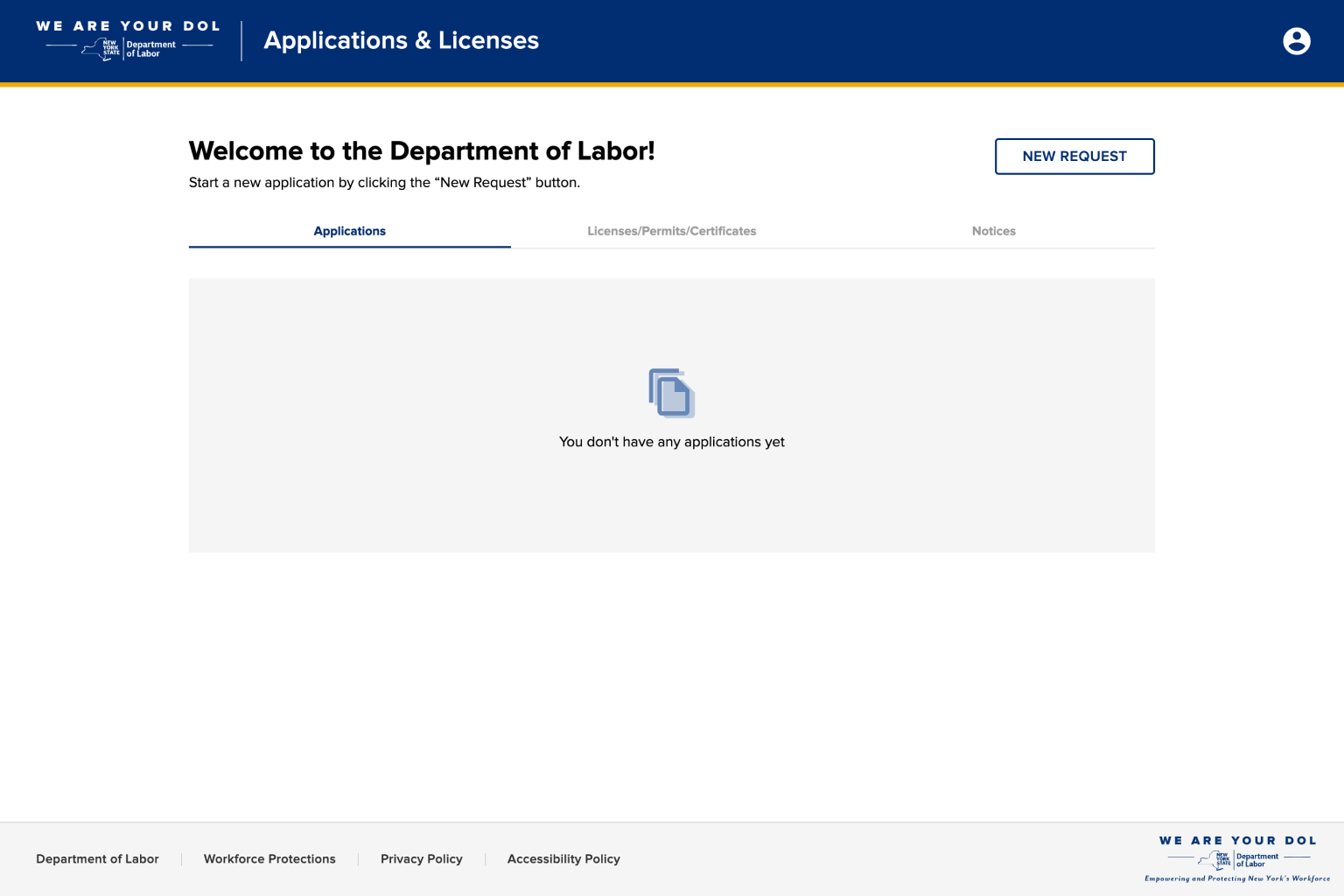

Sign in to NYSDOL MPWR with your NY.gov ID.

- 4.2.

Click “New request” to start an application.

- 4.3.

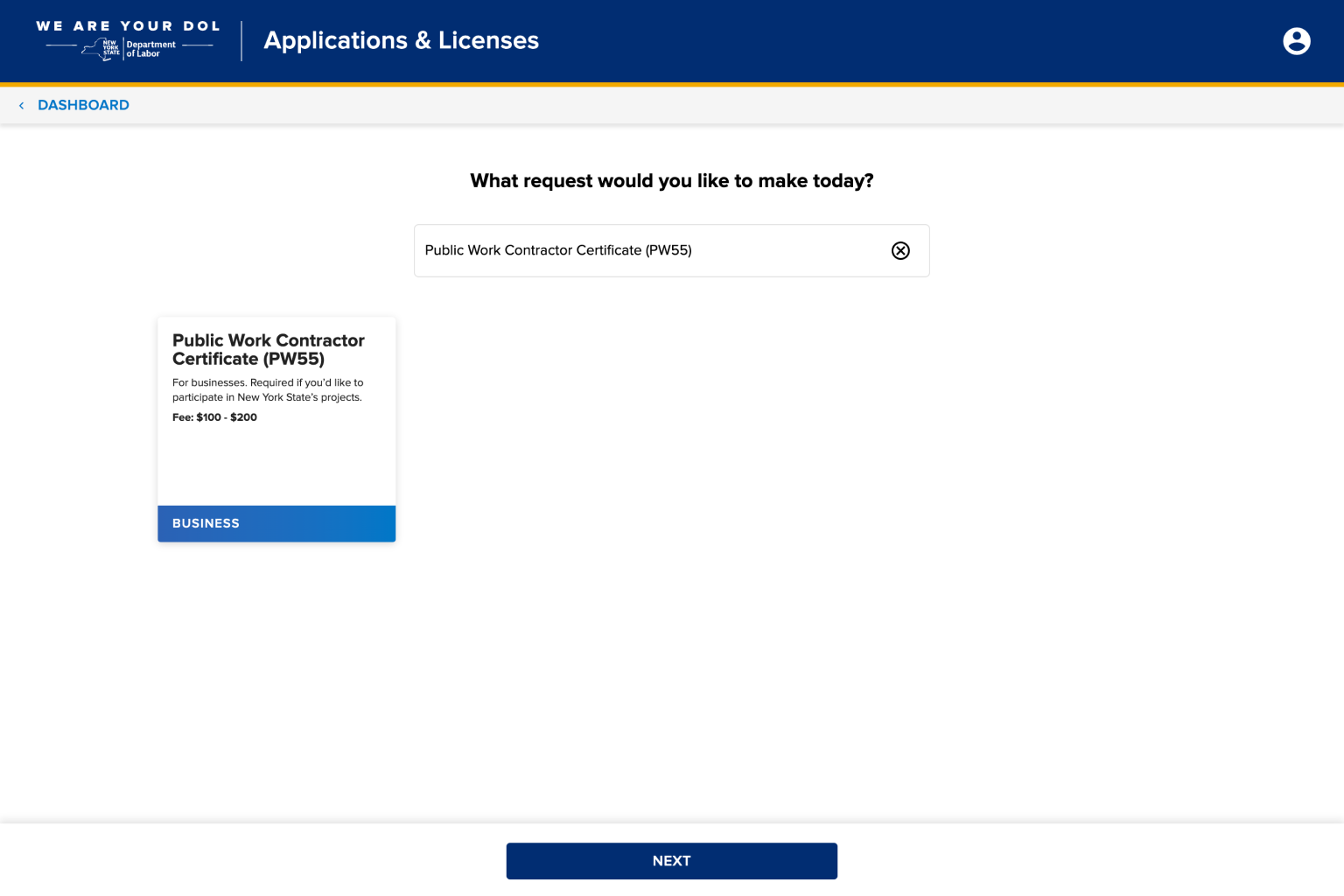

Select “Public Work Contractor Certificate (PW55)” from a dropdown and click “Next”.

- 4.4.

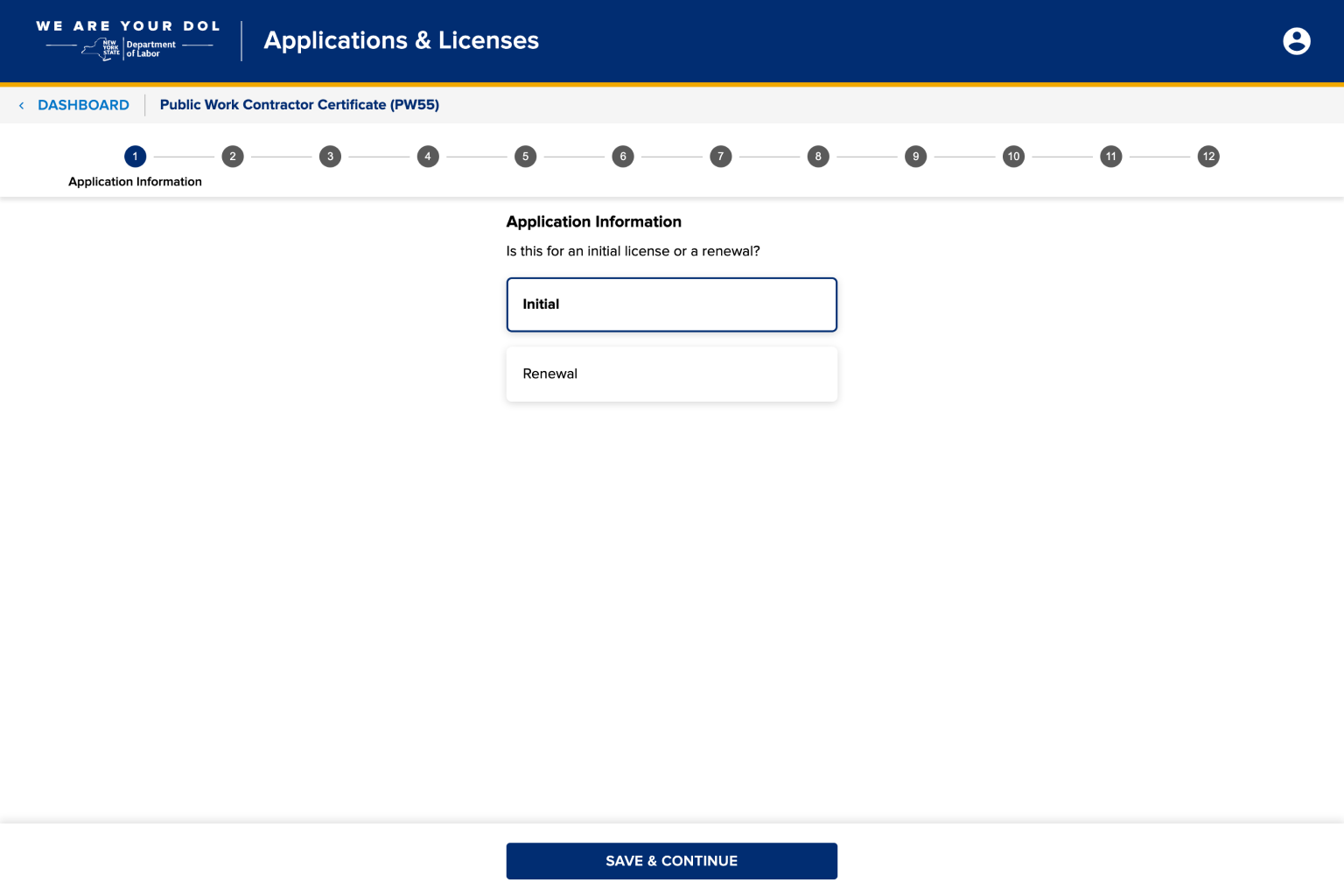

Select whether you are applying for an initial license or renewal and continue.

- 4.5.

Enter your business information and continue to the next step.

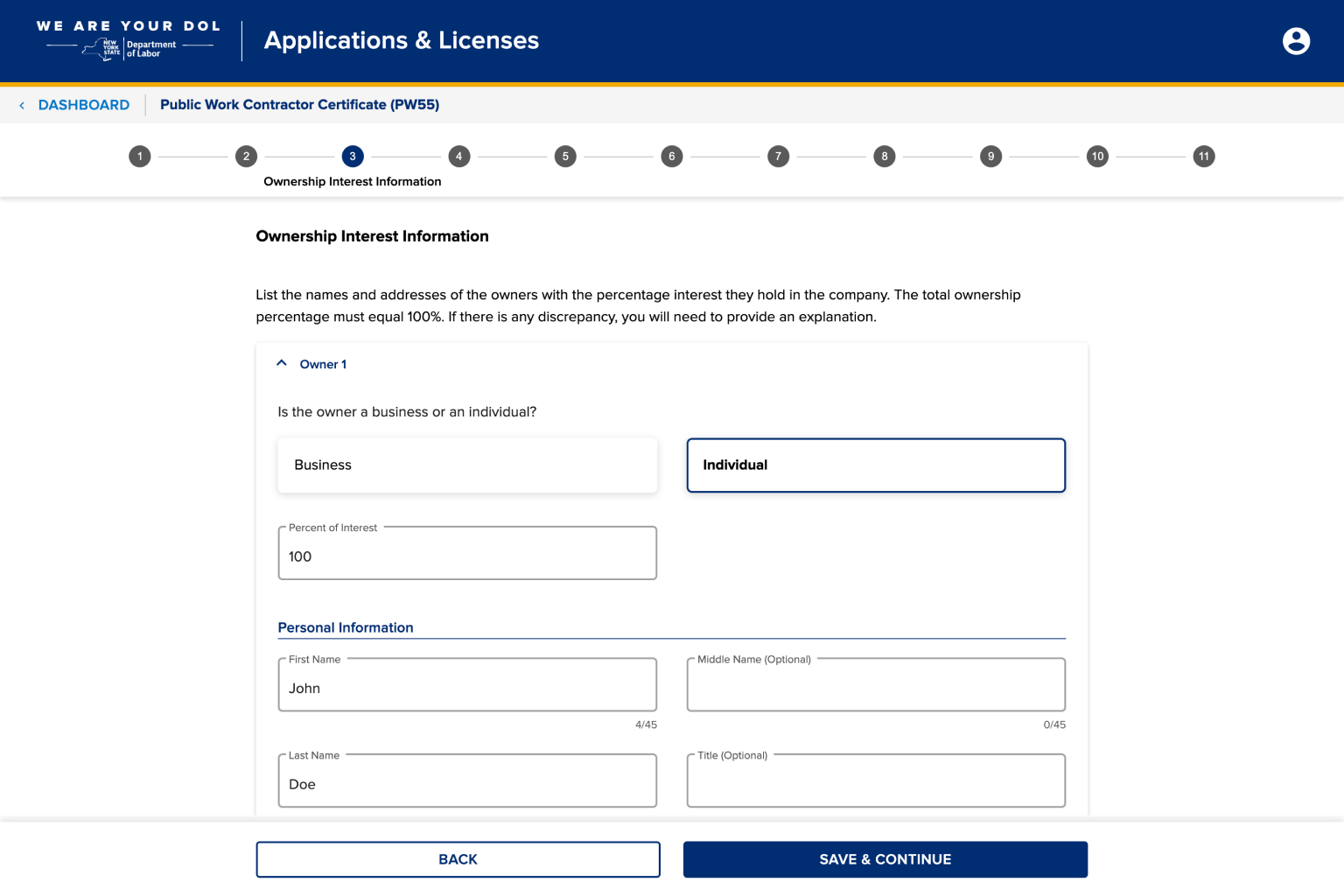

- 4.6.

Enter ownership interest information.

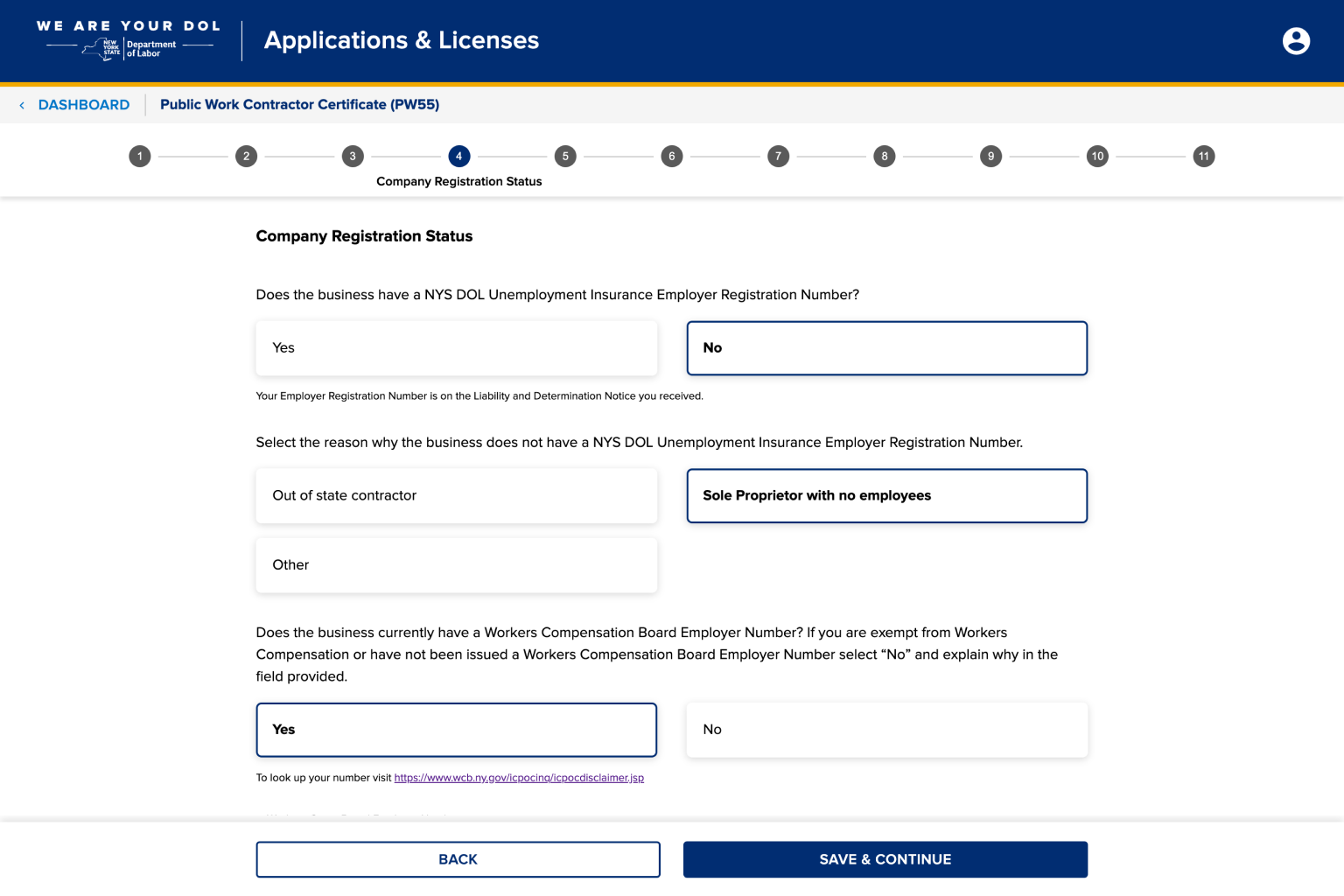

- 4.7.

Enter your company registration status.

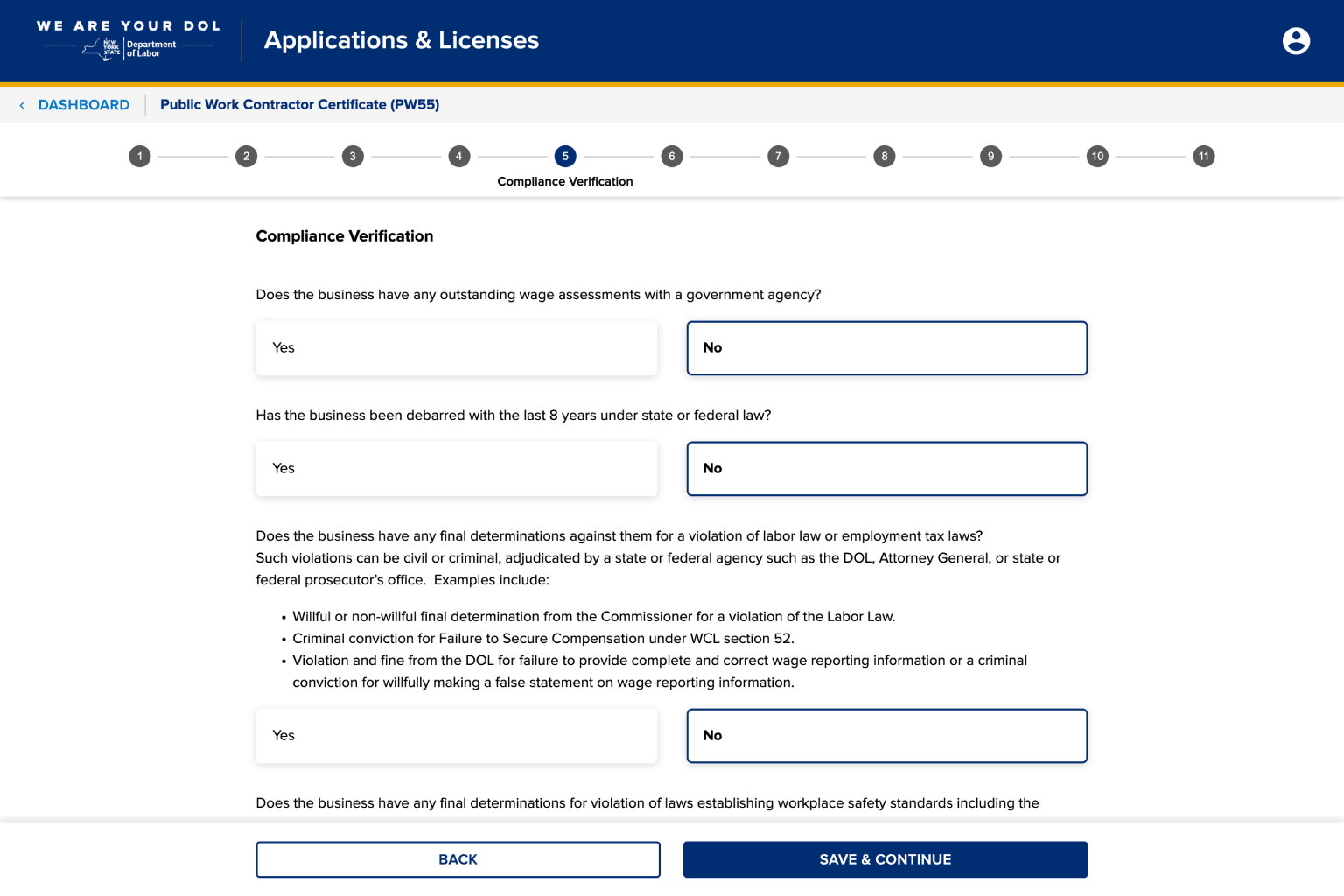

- 4.8.

Answer the compliance verification questions.

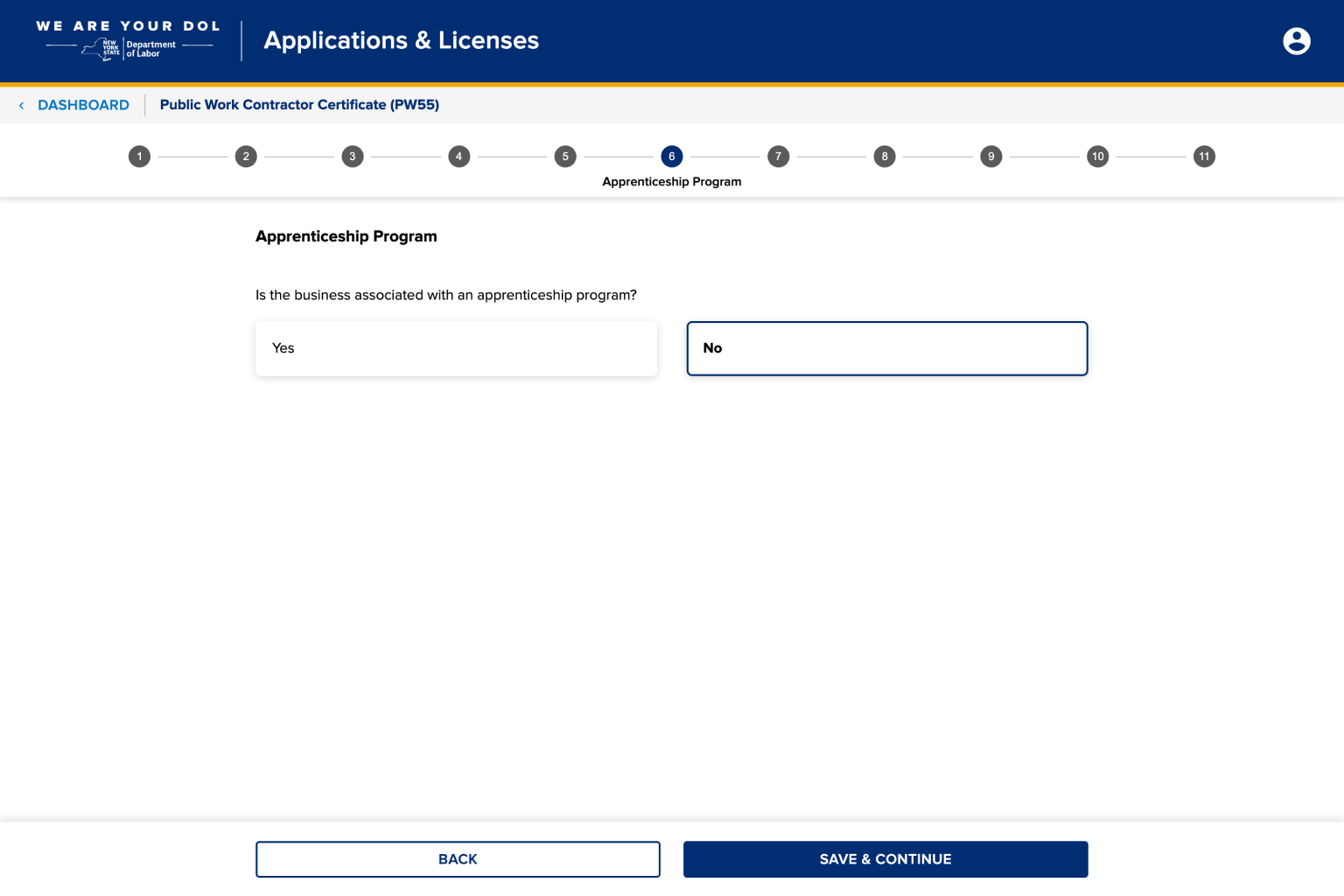

- 4.9.

Enter apprenticeship program participation information.

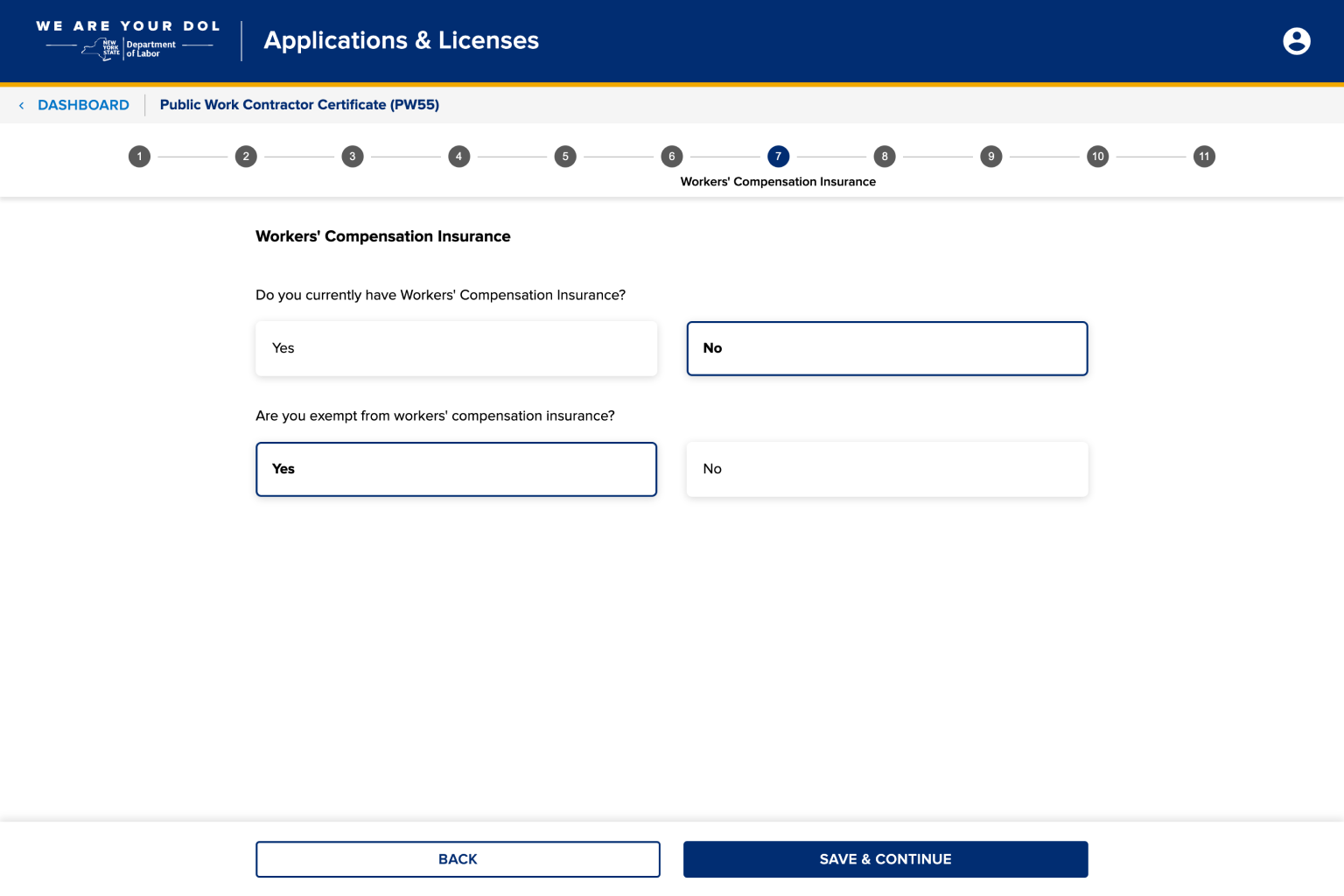

- 4.10.

Answer the workers' compensation insurance question.

- 4.11.

Upload supporting documents in PDF, DOC, or JPEG file format.

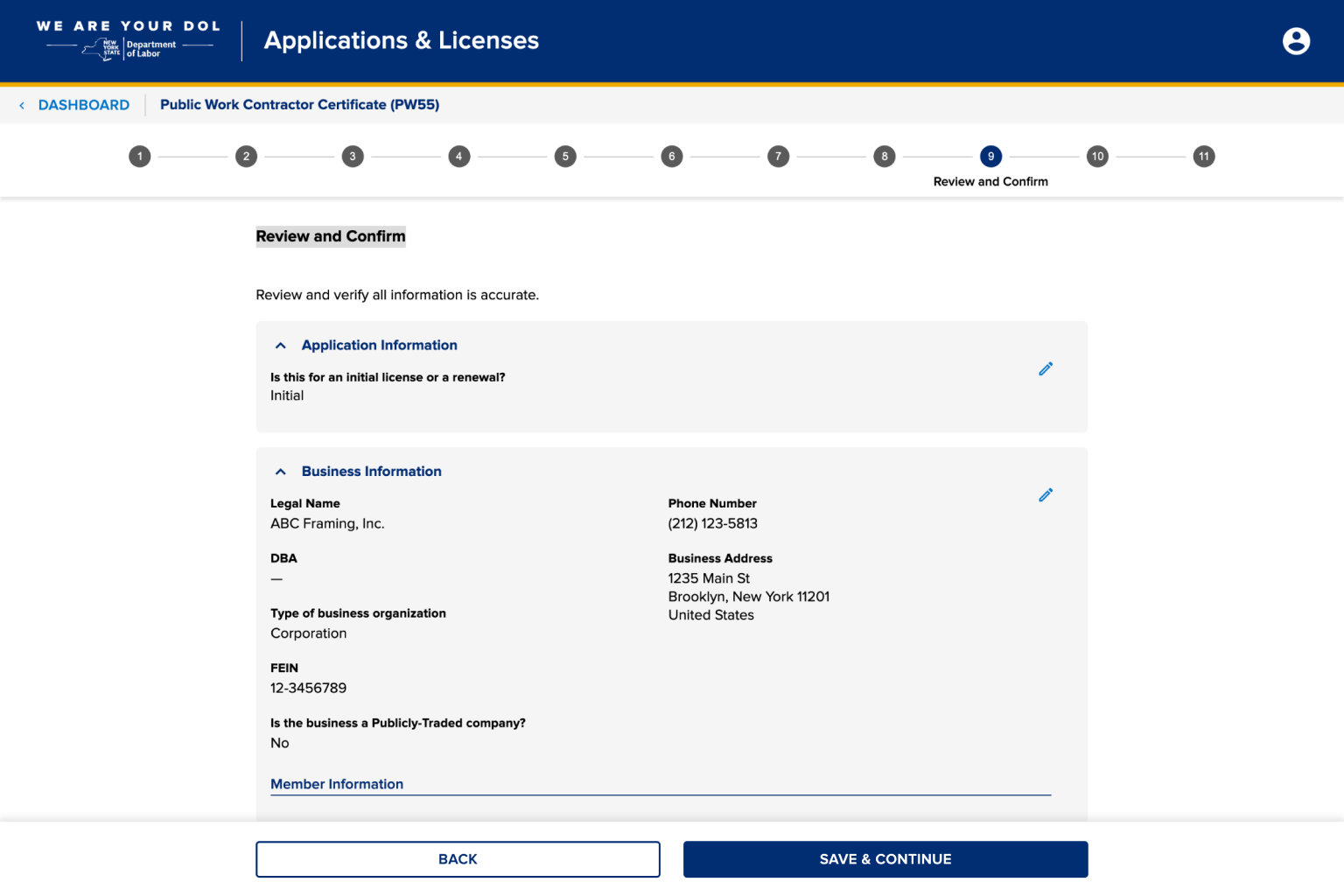

- 4.12.

Review and confirm your information.

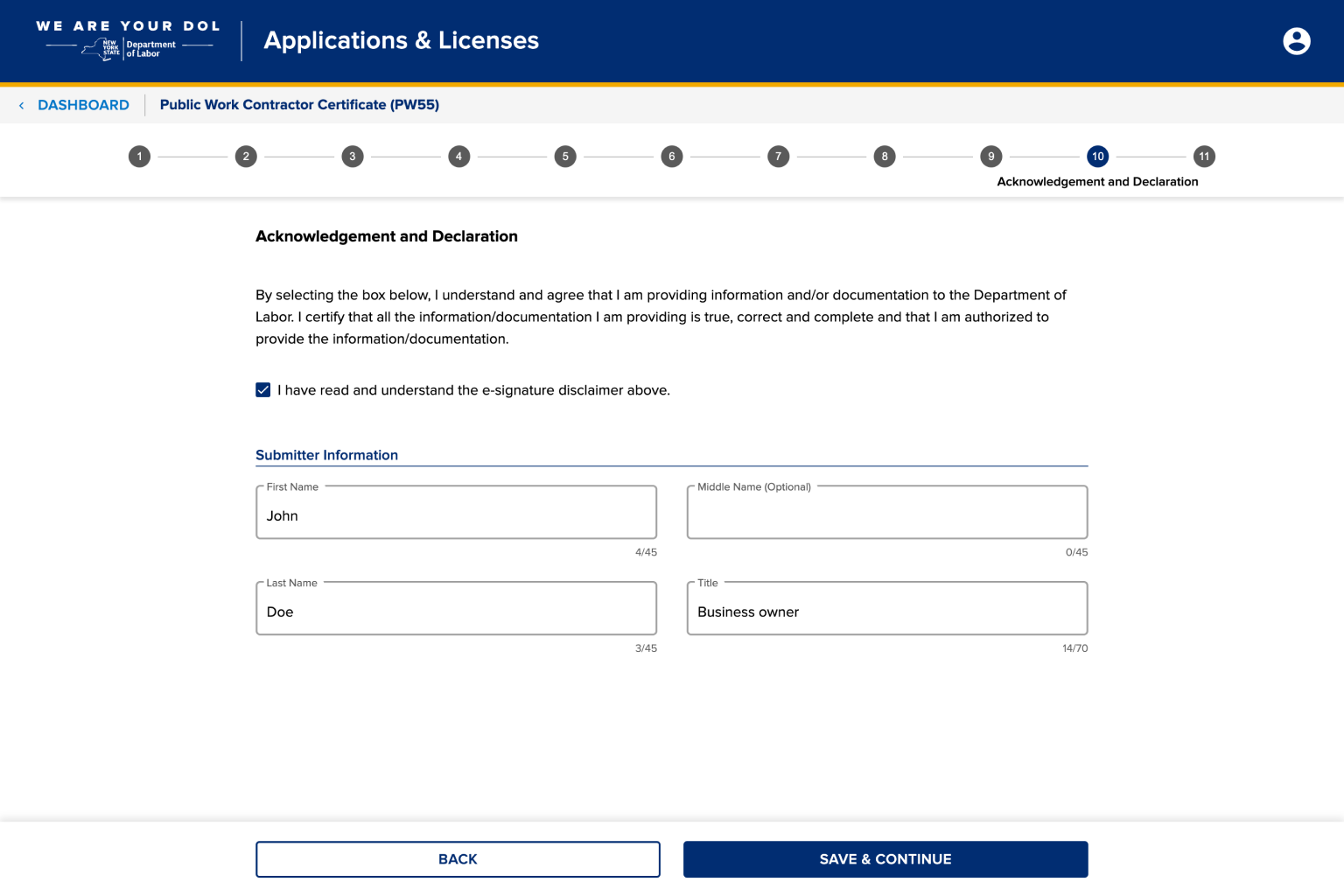

- 4.13.

Read and sign the disclaimer.

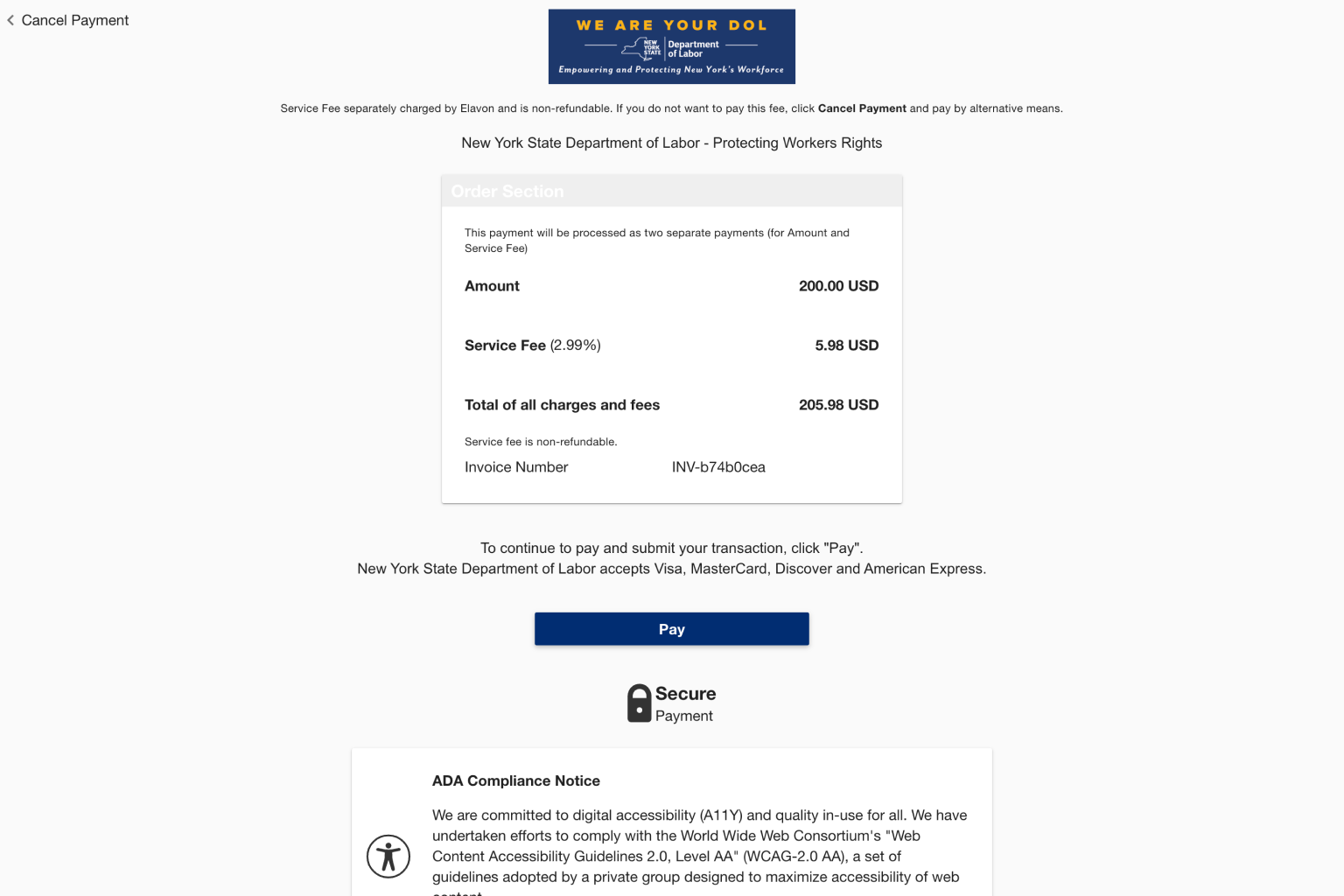

- 4.14.

Pay the nonrefundable $100-200 registration and 2.99% service fee and submit your application.

Receive approval

Registration can take up to four weeks for an application to be reviewed and a PW55 certificate to be issued. If any of the information submitted is incorrect or incomplete it will delay the application process so be sure to gather all of the required documentation and verify its accuracy. You can check the status of your application through the Contractor Registry portal.

Once approved, your Certificate of Registration and its unique registration number will be issued electronically via the Contractor Registry portal which you can then download or print.

Certificates are valid for two calendar years starting on the date they are issued and contractors and subcontractors need to renew their registration at least 90 days before they expire.

Work safe.